Luminance

Luminance

A finance management tool that challenges fast-spending culture in order to nurture mindful financial habits

/Product design + Experience design

/Product design + Experience design

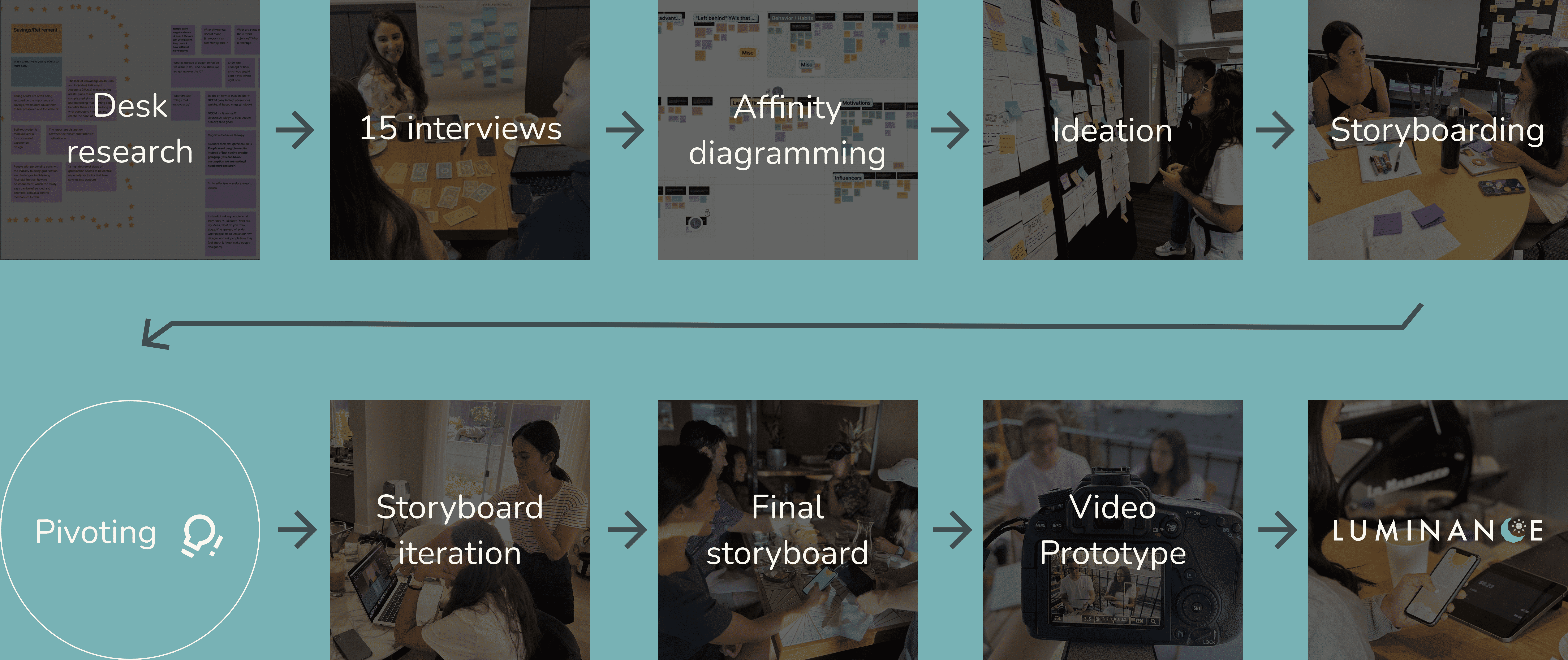

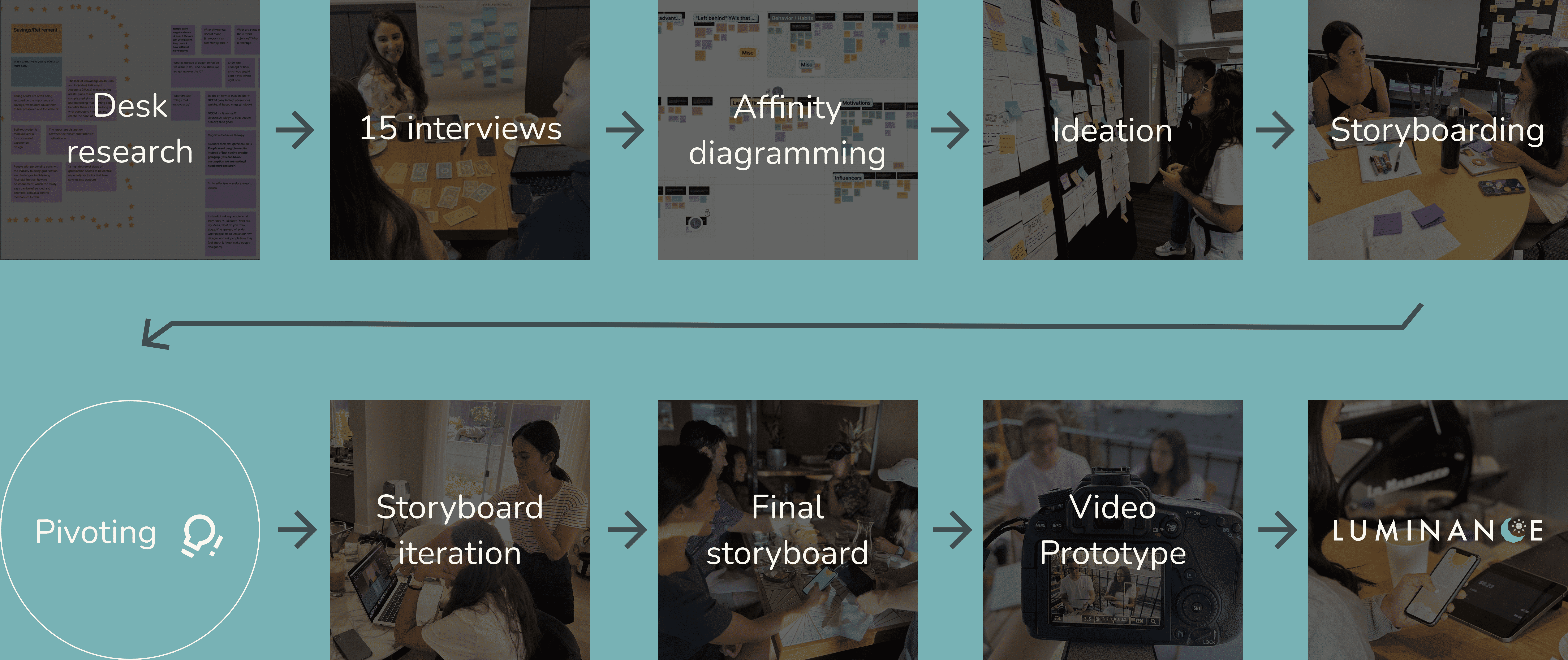

TIMELINE

20 weeks

ROLES

Product Designer

Visual Designer

User Researcher

ADVISOR

Holly Hirzel

Axel Roesler

Scott Ichikawa

TEAM

3 Designers

OVERVIEW

Over the course of 20 weeks, the team found that many young adults prioritize the present over retirement planning, so we designed a finance management tool that nurtures reflective financial habits, allowing young adults to better balance their saving and spending.

MY ROLE

As the UX designer, I planned and conducted user research, including literature reviews, cultural probes, competitor analysis, and user interviews. I also led the visual design, created user flows, mockups, and the design system, iterated designs by creating various storyboards, photographed the hero image, created animations, and directed/edited a video prototype to demonstrate the ideal experience.

DESIGN

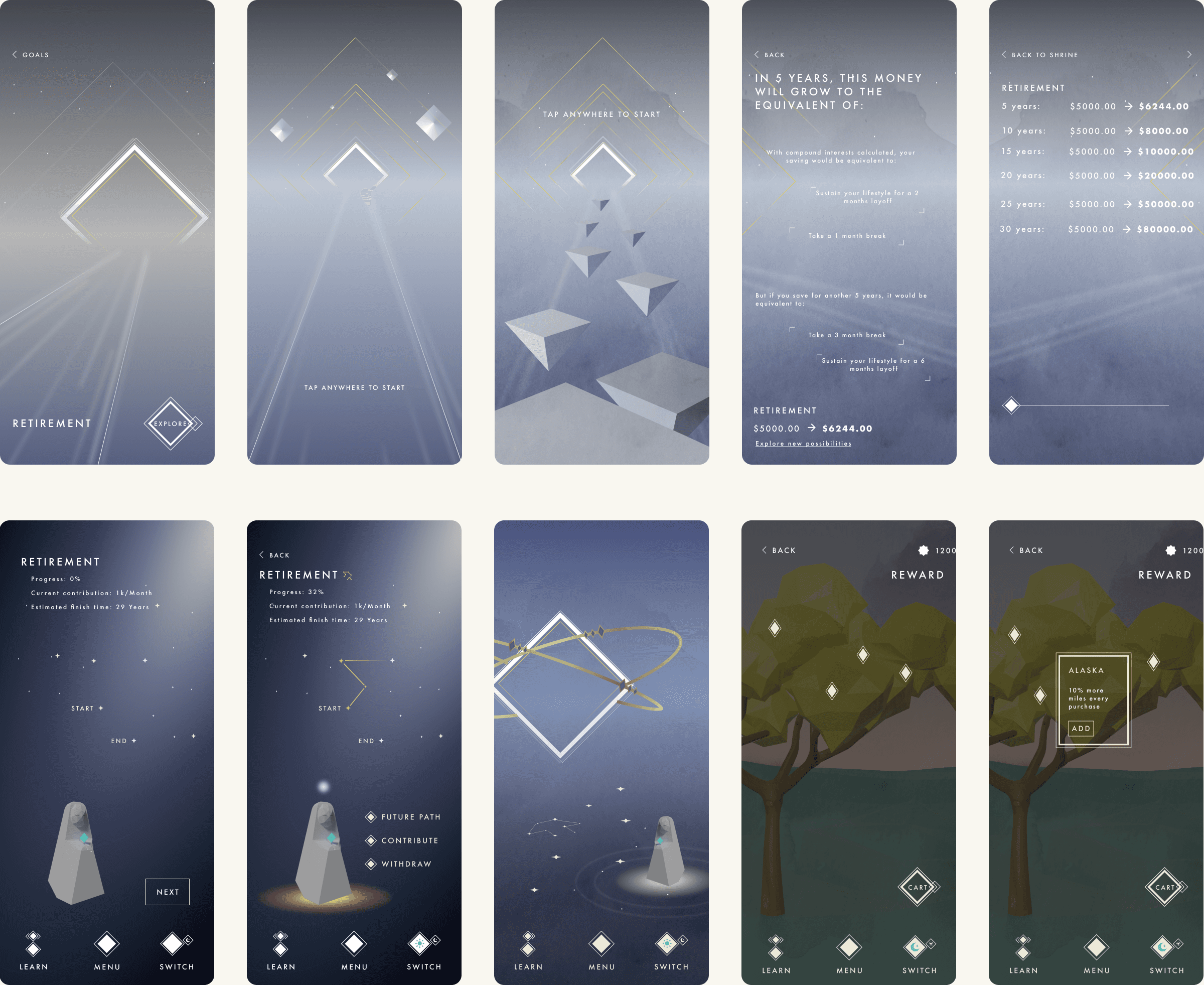

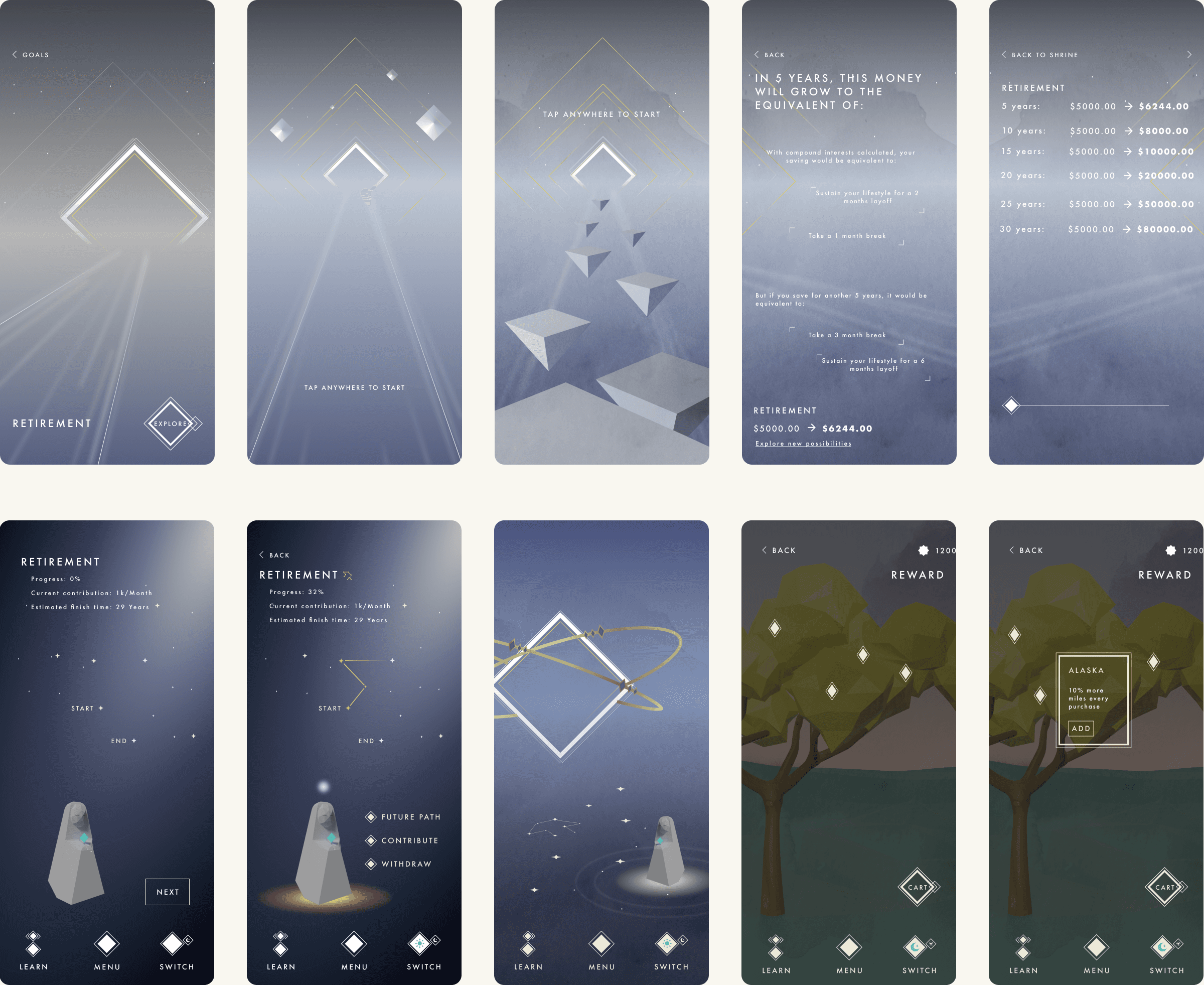

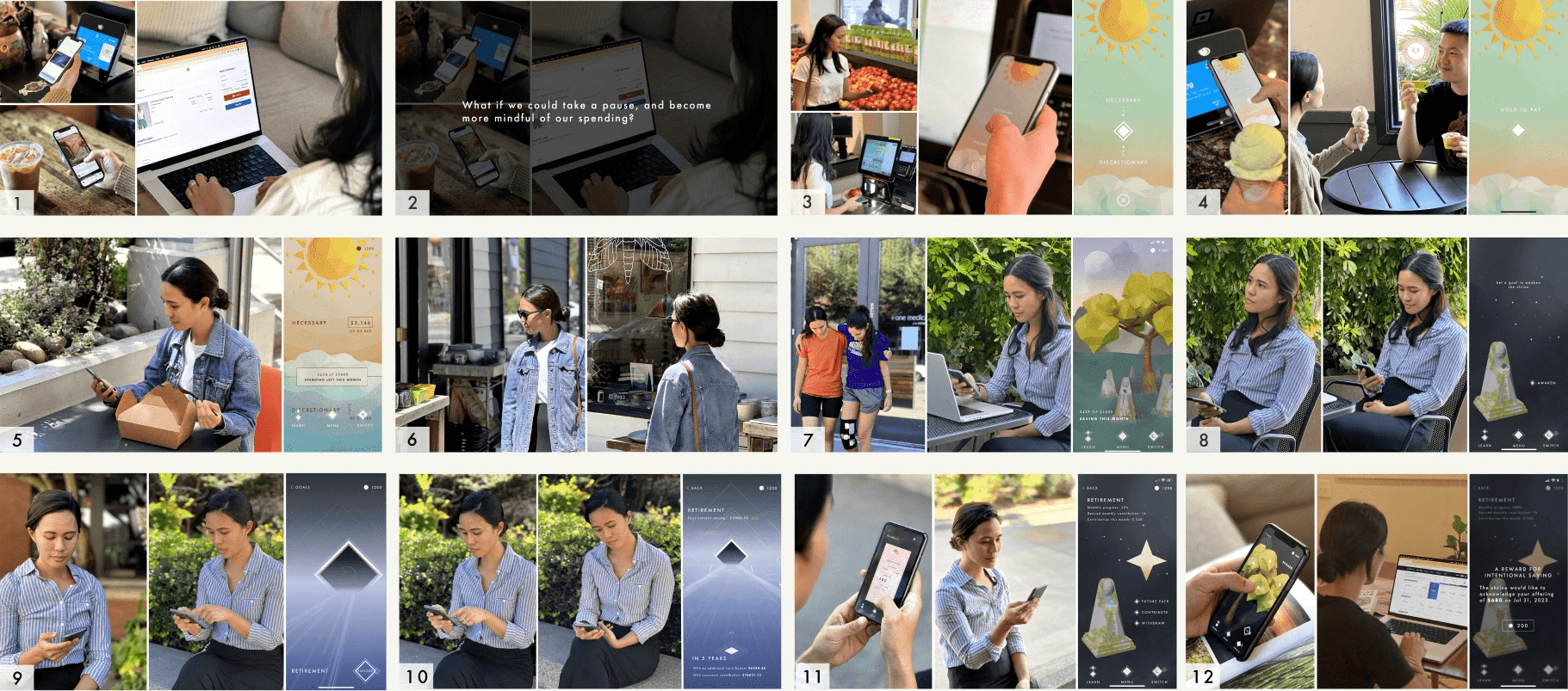

Features

Main Touch-Points

Our design touches on 5 different touch-points that work together to help young adults develop good financial habits

Spending - Include resistance to prompt refections when making a purchase

By holding on the payment button, users can have time to think about what that purchase means to them so they can be more mindful of their spending.

(It may take a few seconds to load the video)

Spending - Categorize the purchase right at the moment

Users can swipe up or down to categorize their spending right at the moment as they complete the transaction, eliminating the need for future categorization.

(It may take a few seconds to load the video)

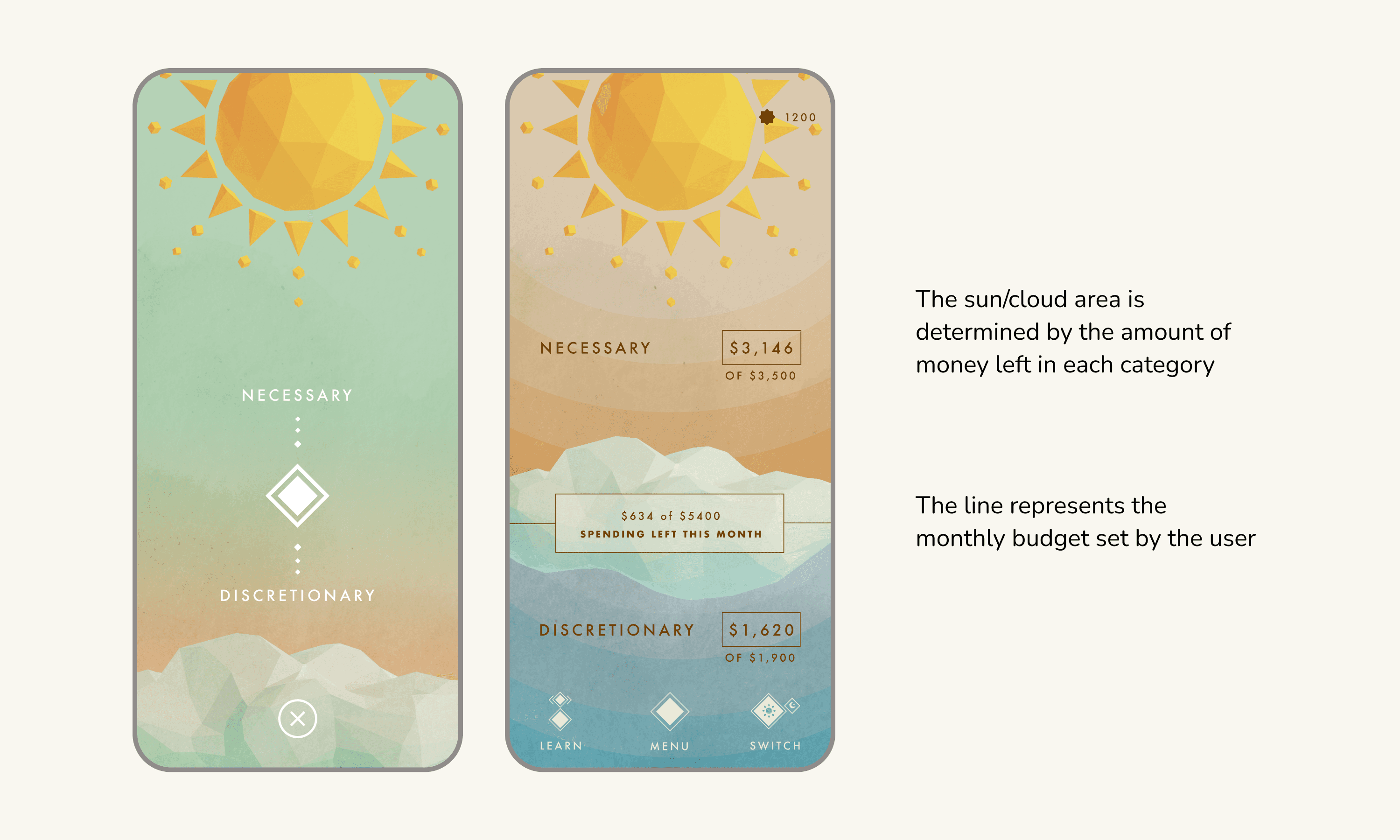

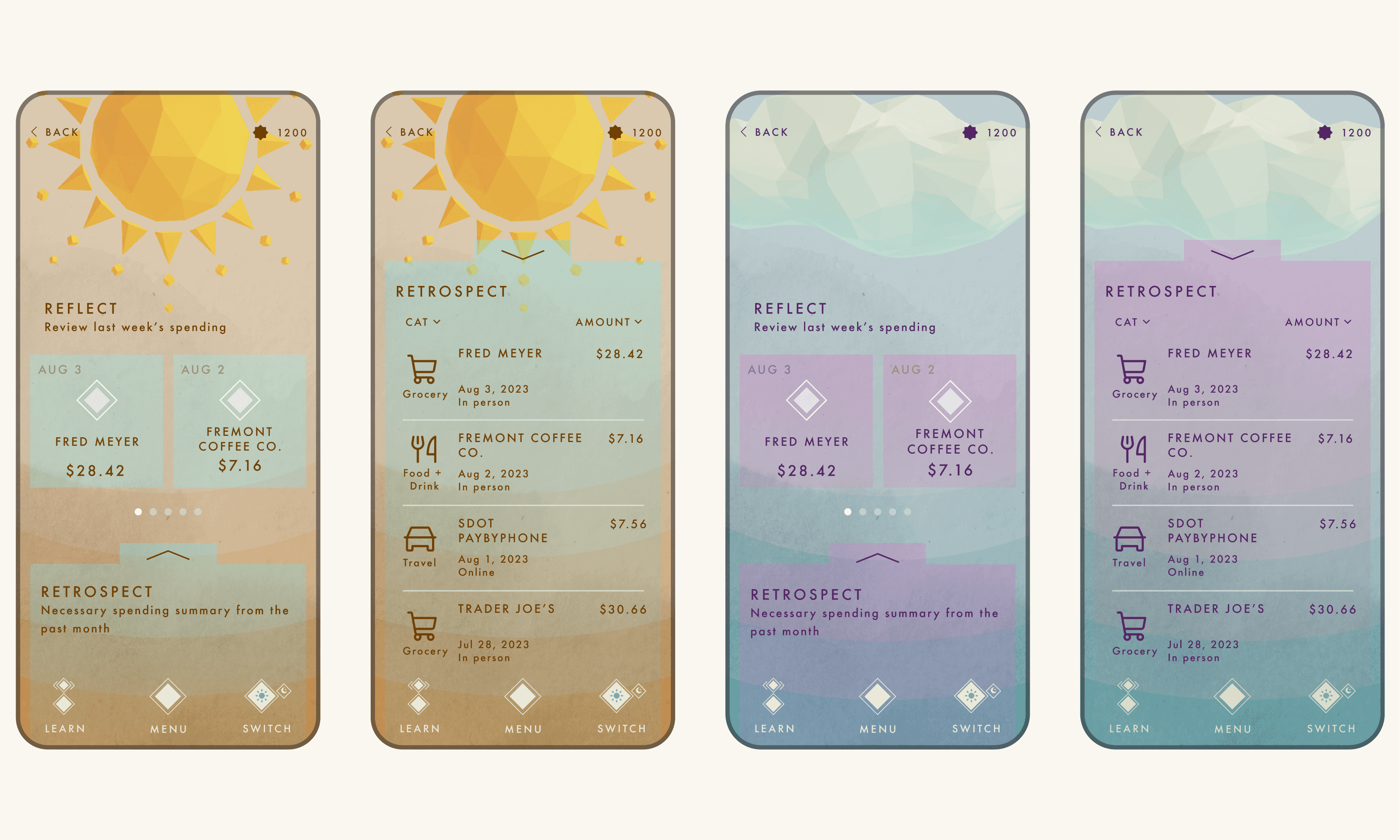

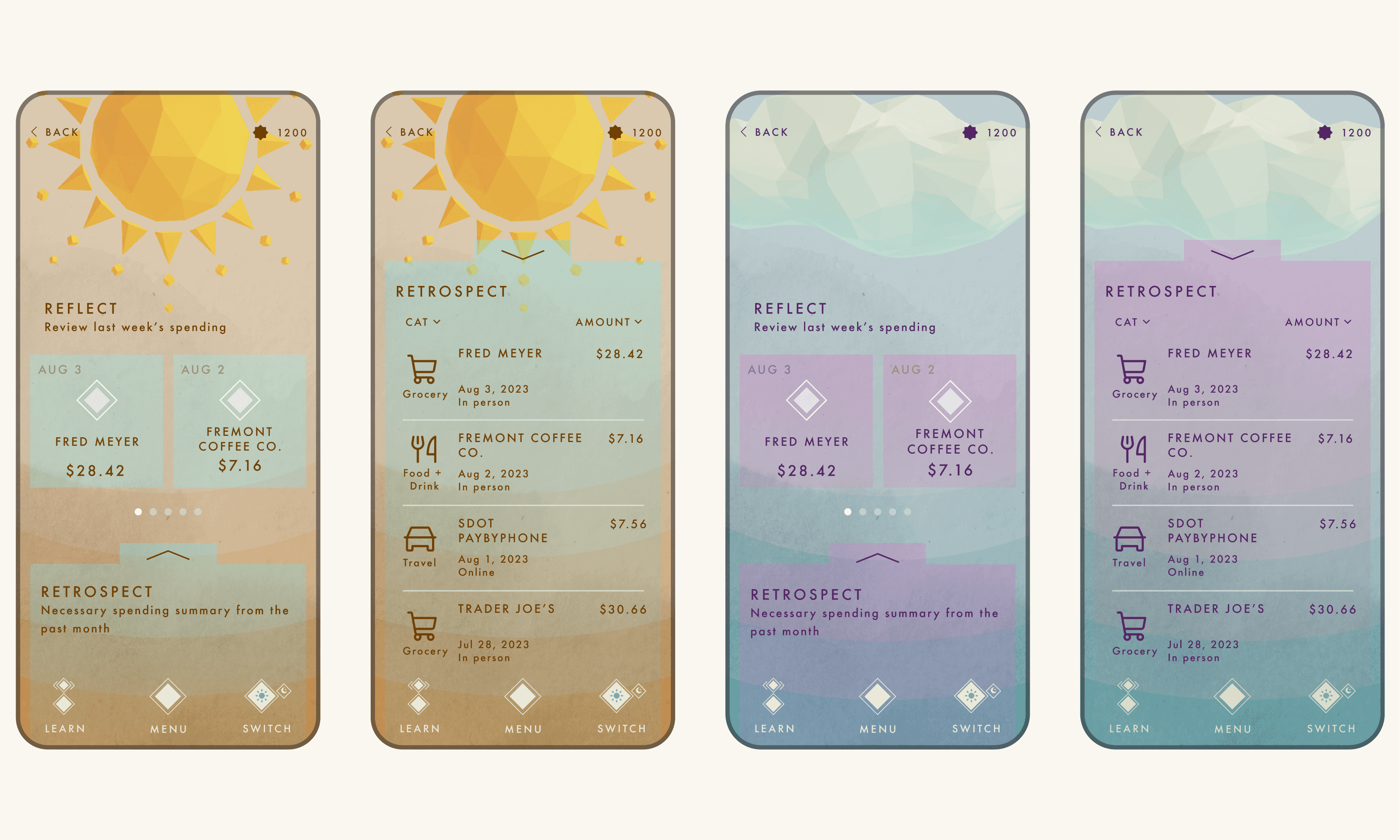

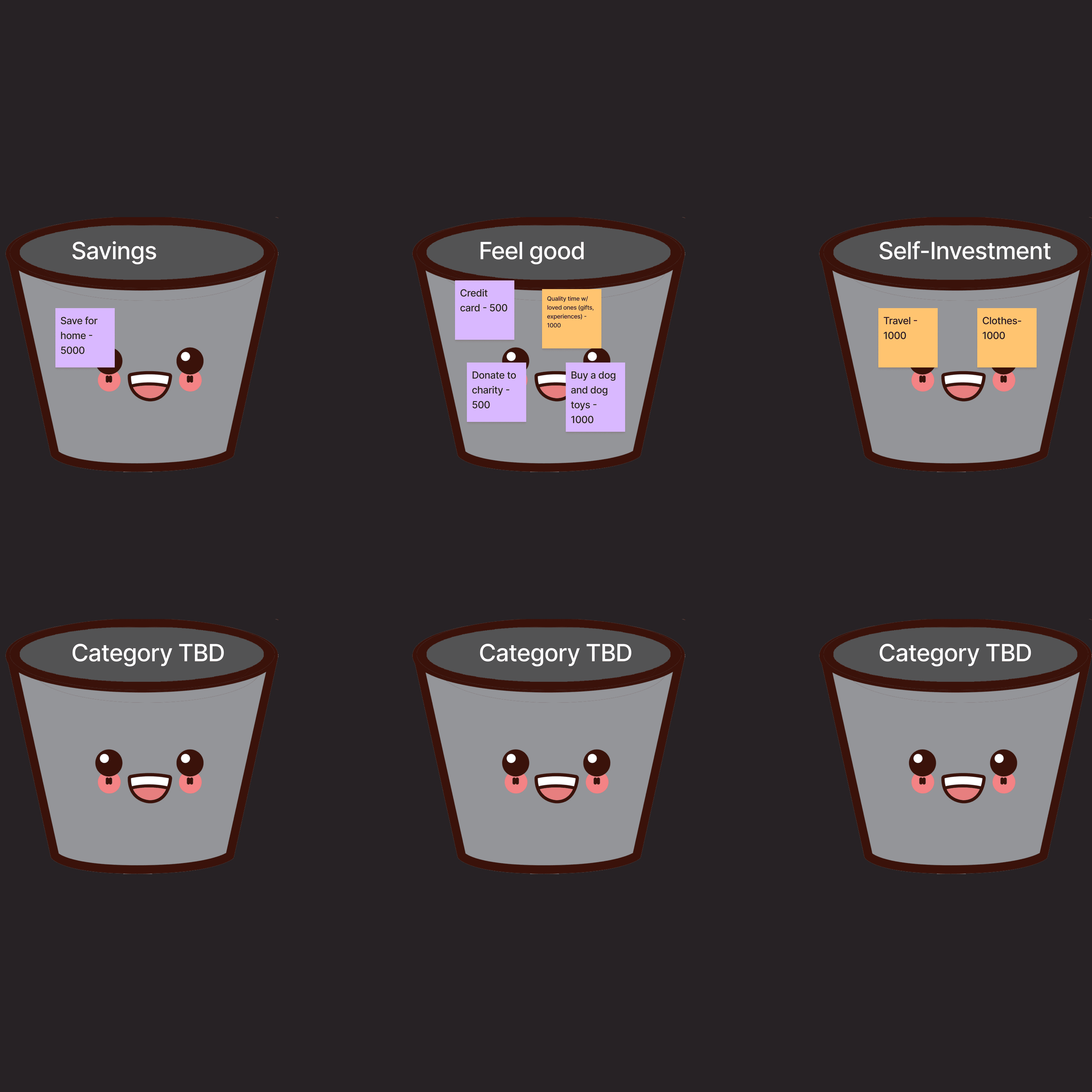

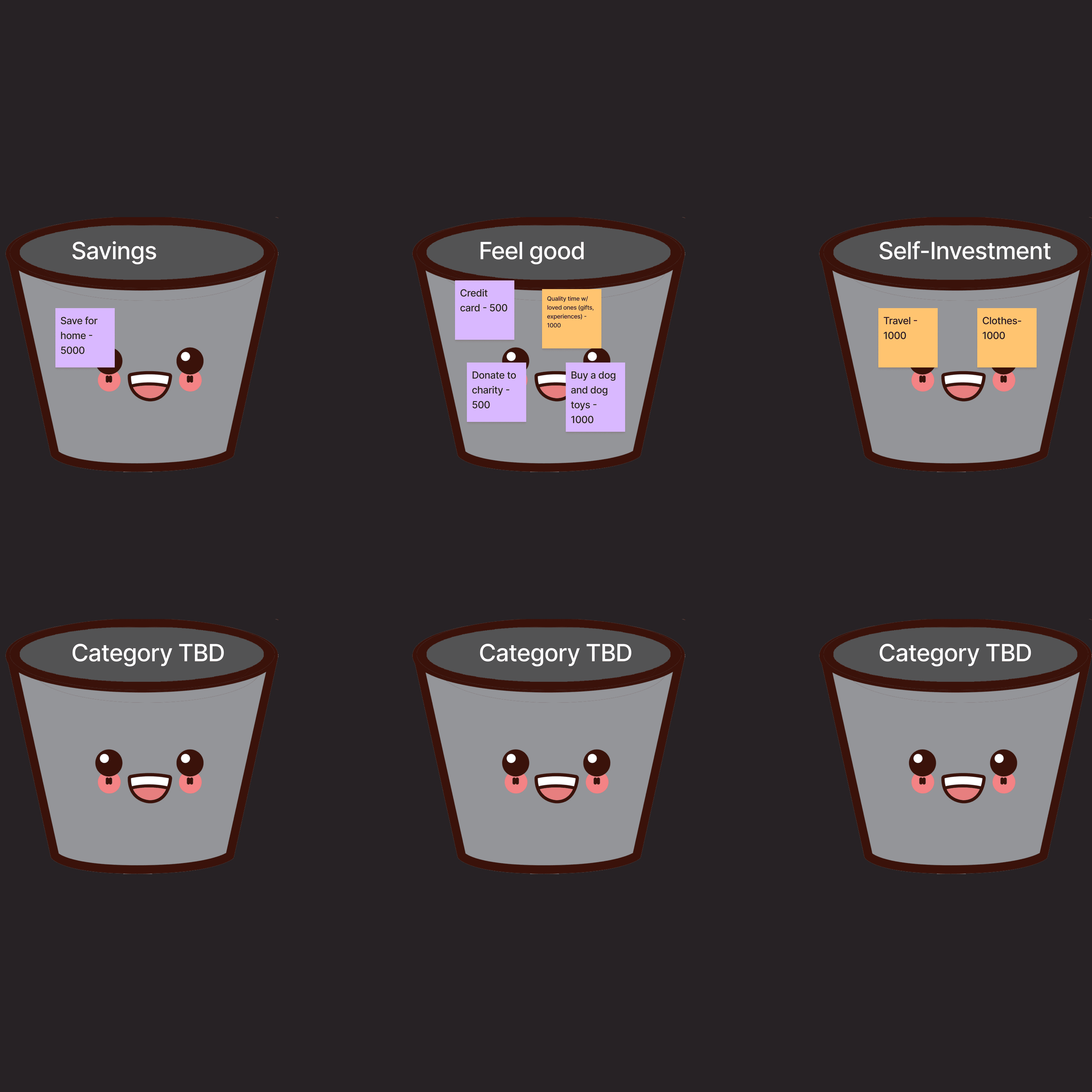

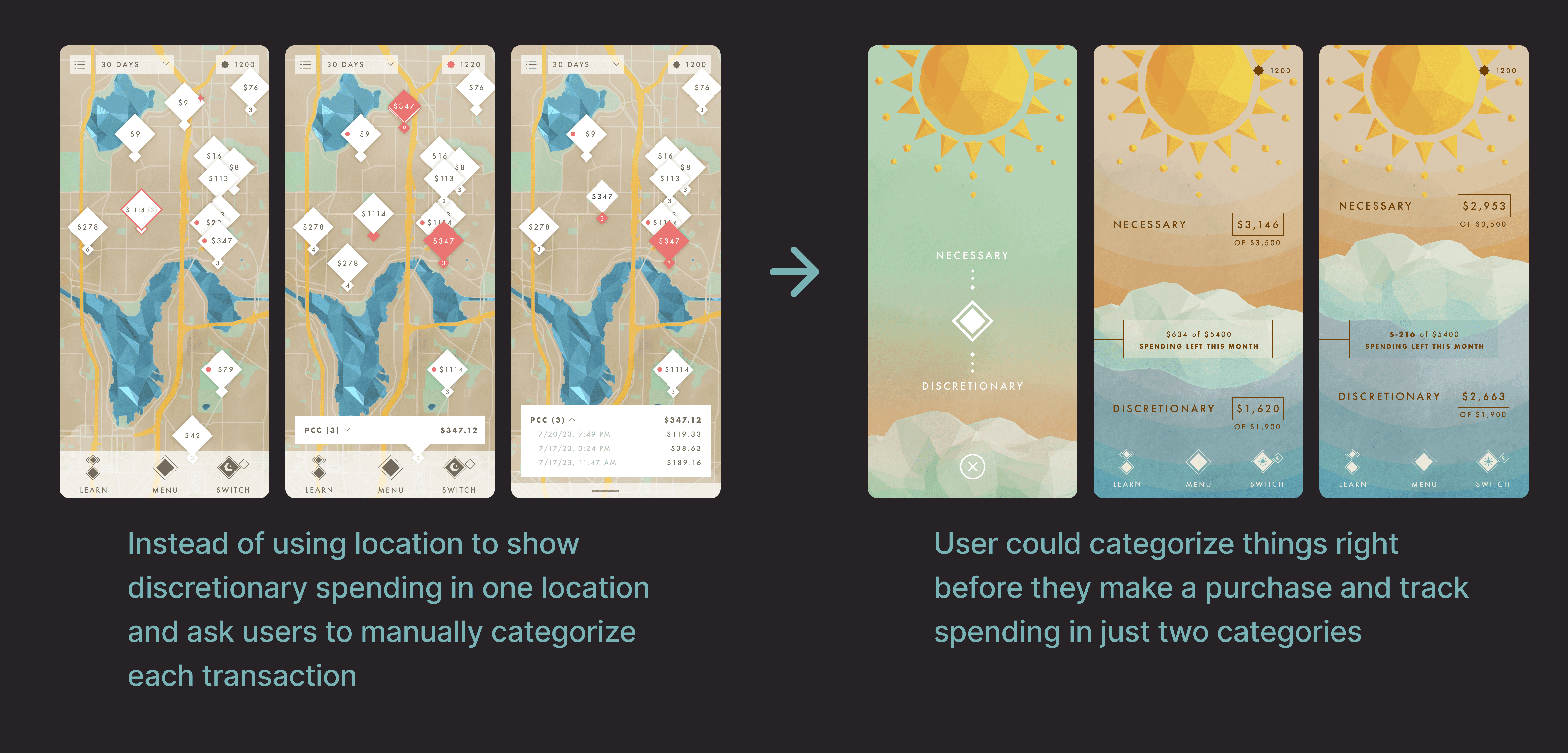

Finance Tracking - Keep track of spending with just two categories

Users can view spending breakdowns and manage finances simply in two categories—necessary and discretionary—to simplify spending tracking.

Finance Tracking - Use detailed breakdowns to support informed financial decisions.

Users can look even further into where and what they spent on, so they can better reflect and plan their future spending

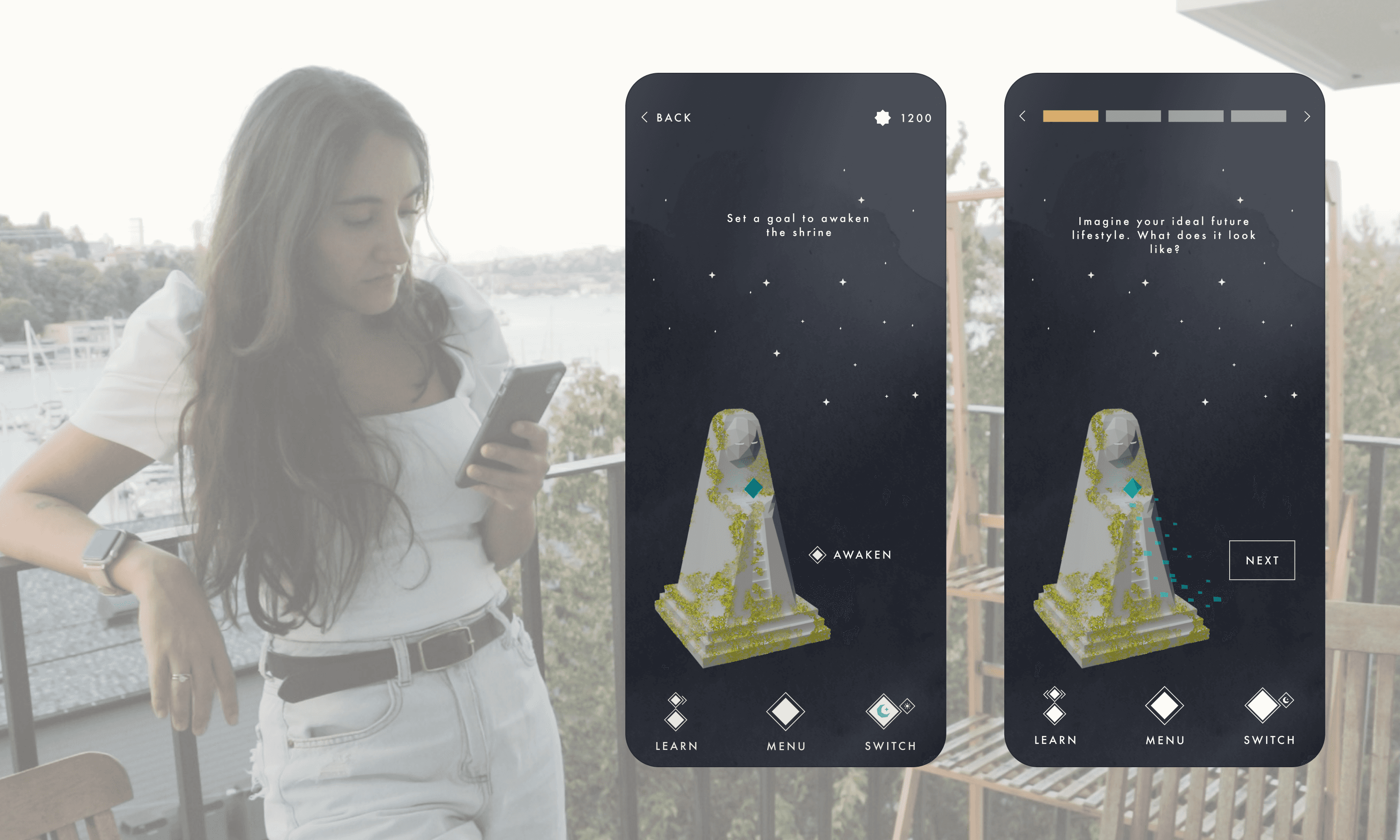

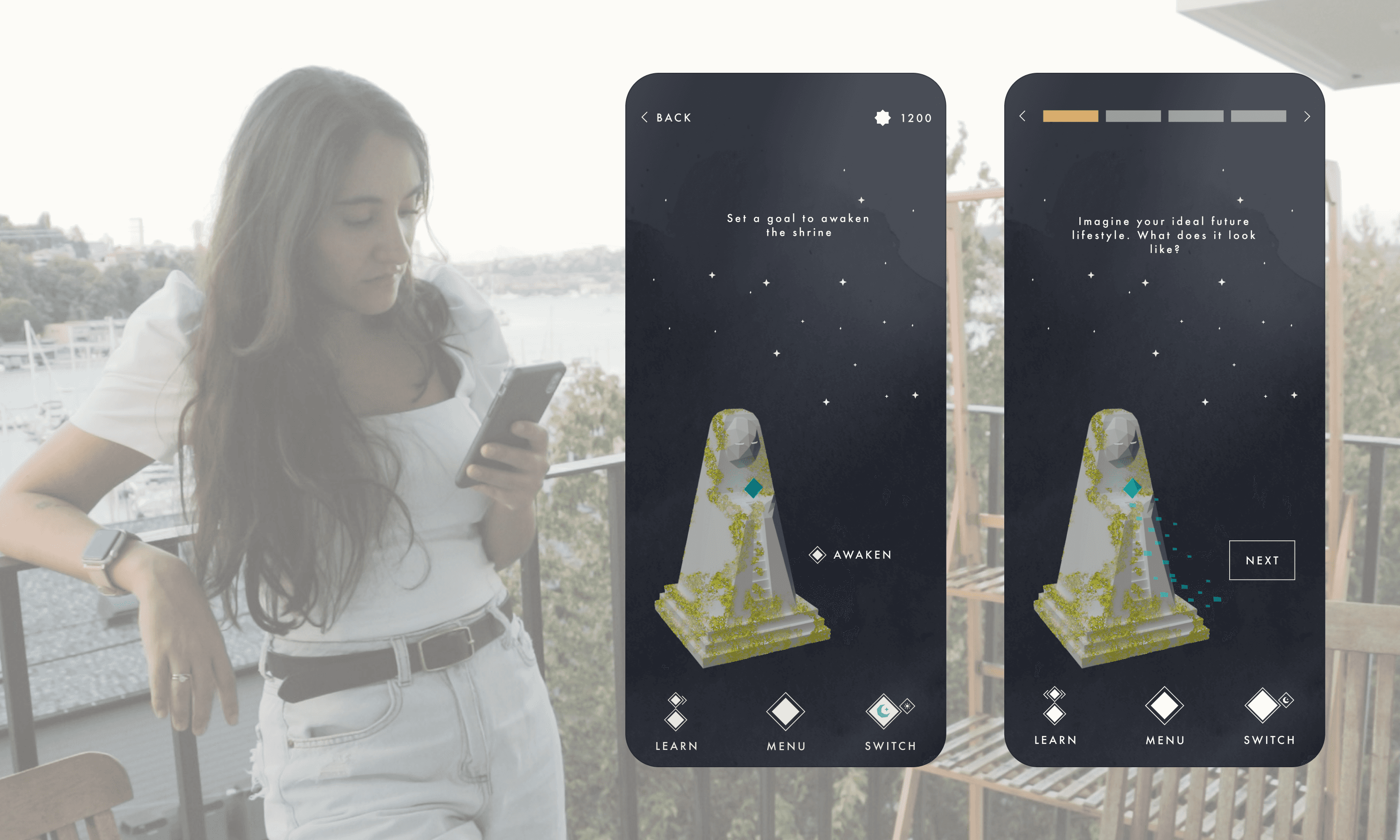

Future Envisioning - Use imagination to Contextualize the future savings goals

Imagination is used to help users visualize an ideal future lifestyle and contextualize their saving goal in order to increase their motivation to save.

Future Envisioning - Explore different opportunities based on the current savings

By navigating the future path, users can explore different things they could do with their savings in the future and better contextualize their saving goals.

(It may take a few seconds to load the video)

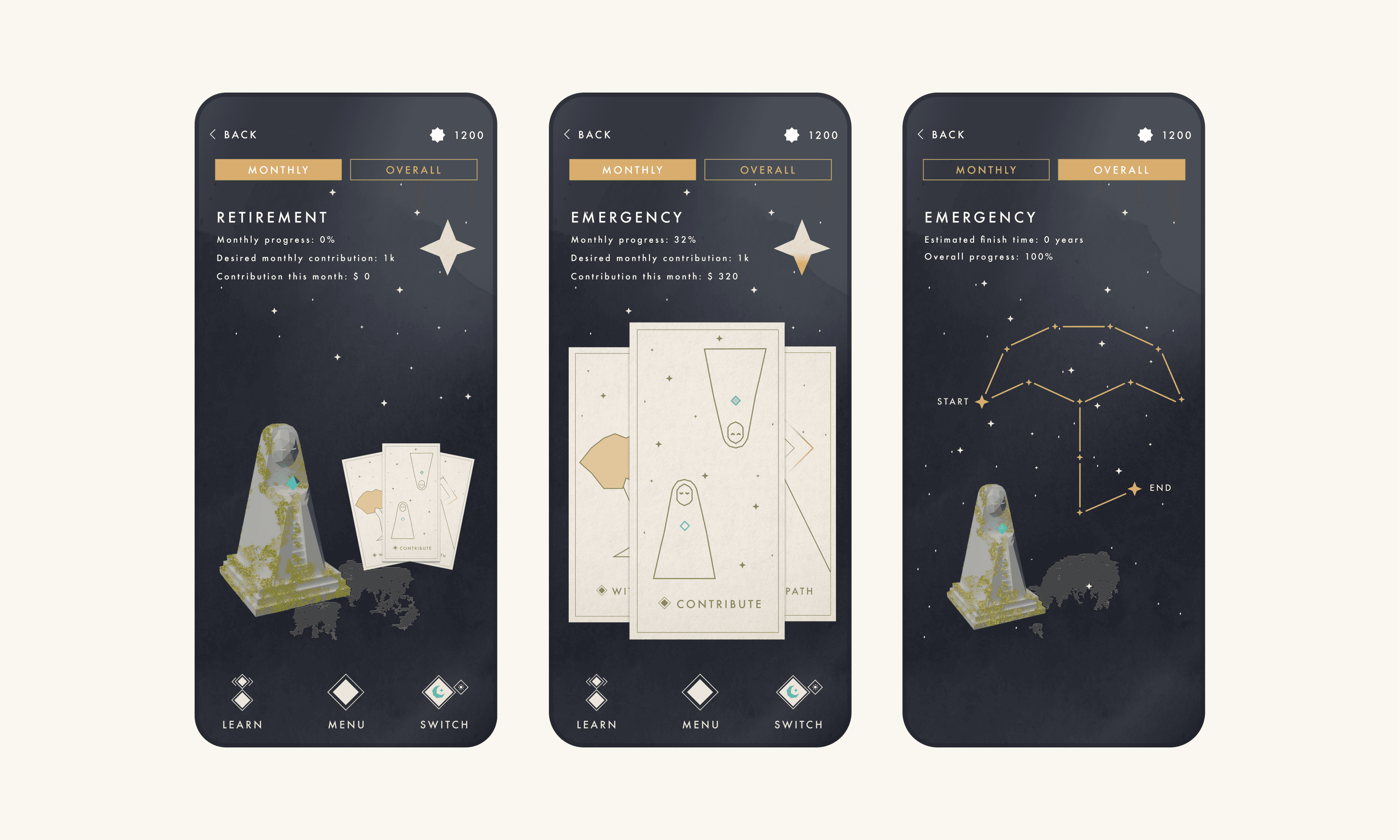

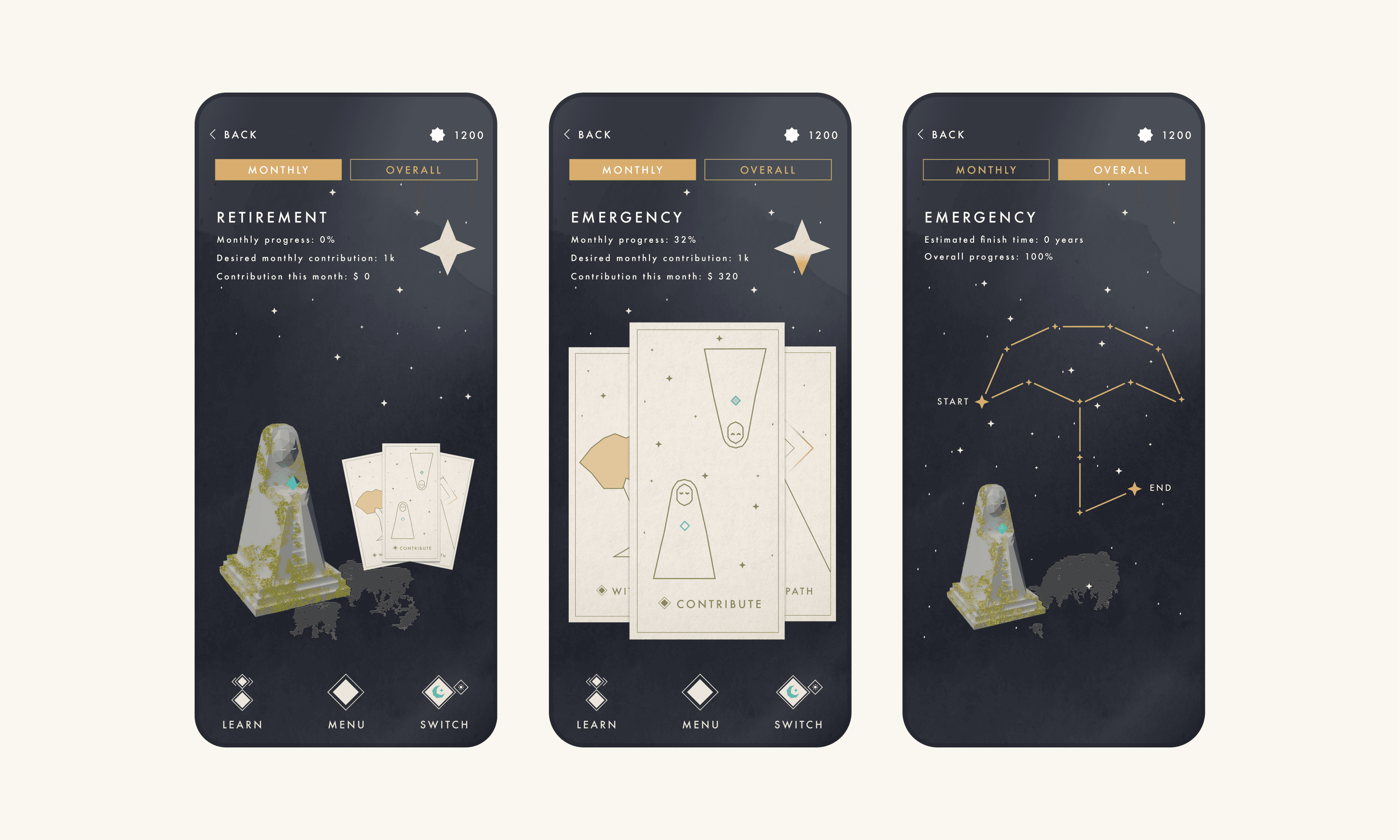

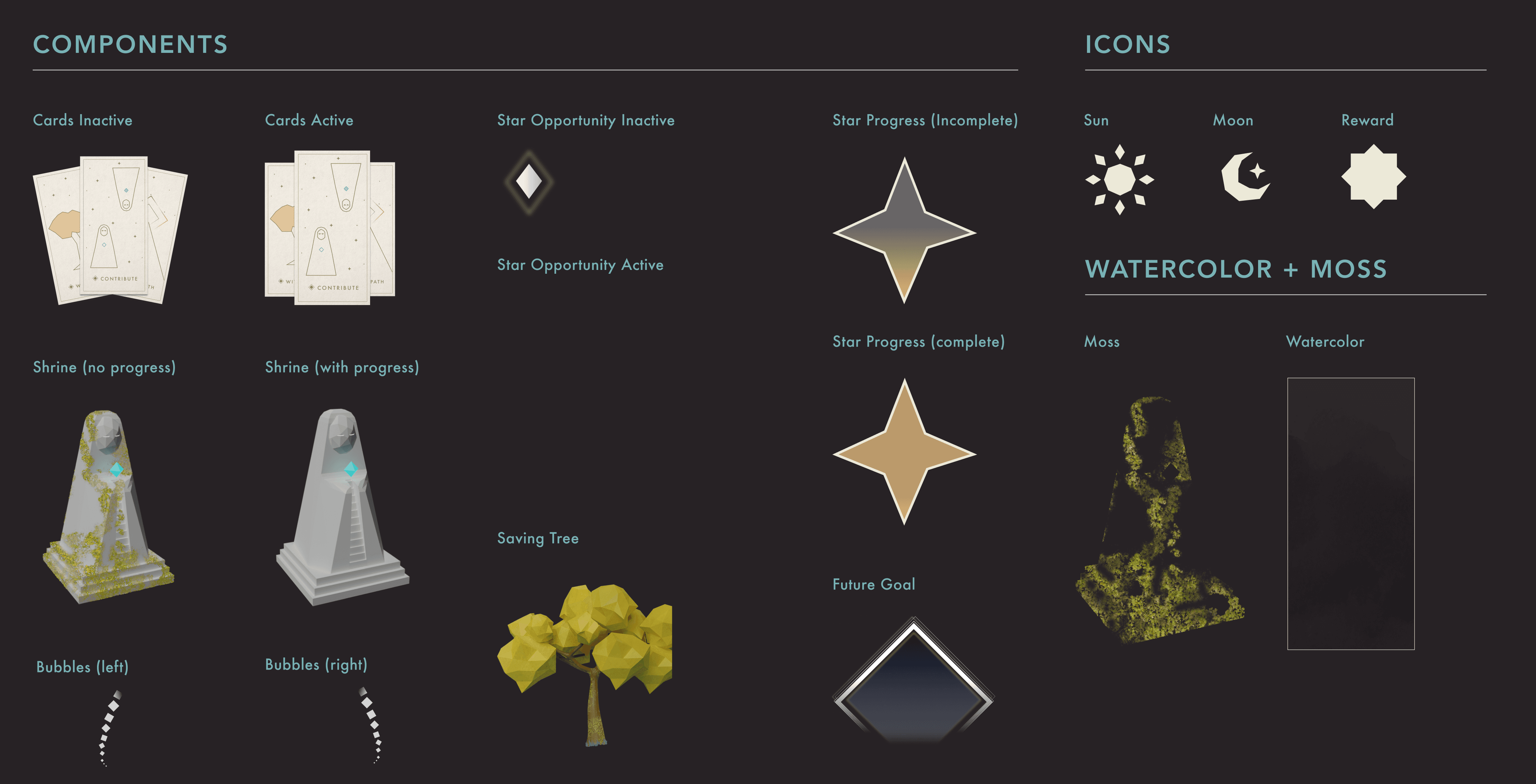

Saving - constellations are used To represent goals and guide users through Their future

Constellations are used as metaphors to represent goal progress in a step-by-step format, making long-term goals feel more achievable and motivating users to save.

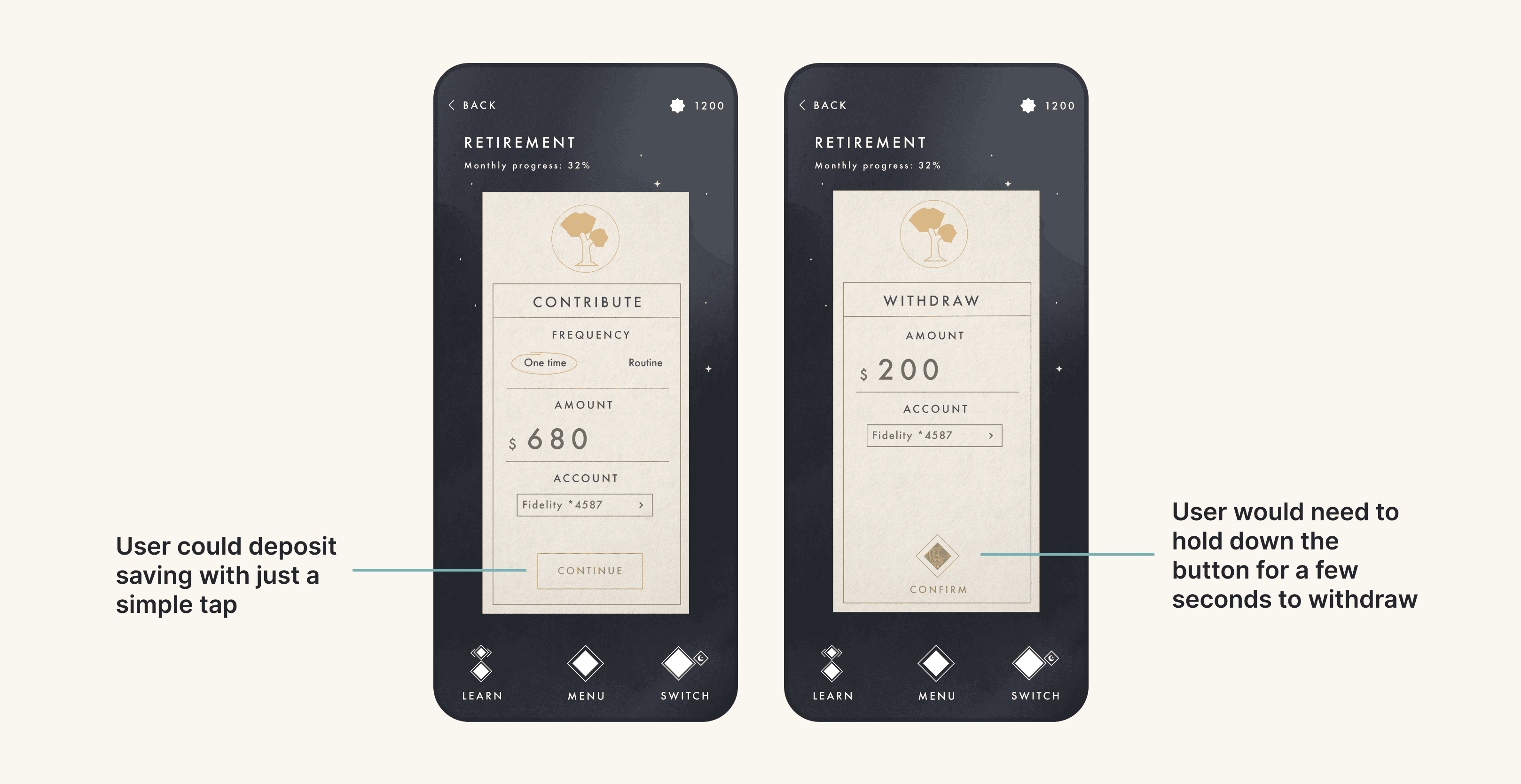

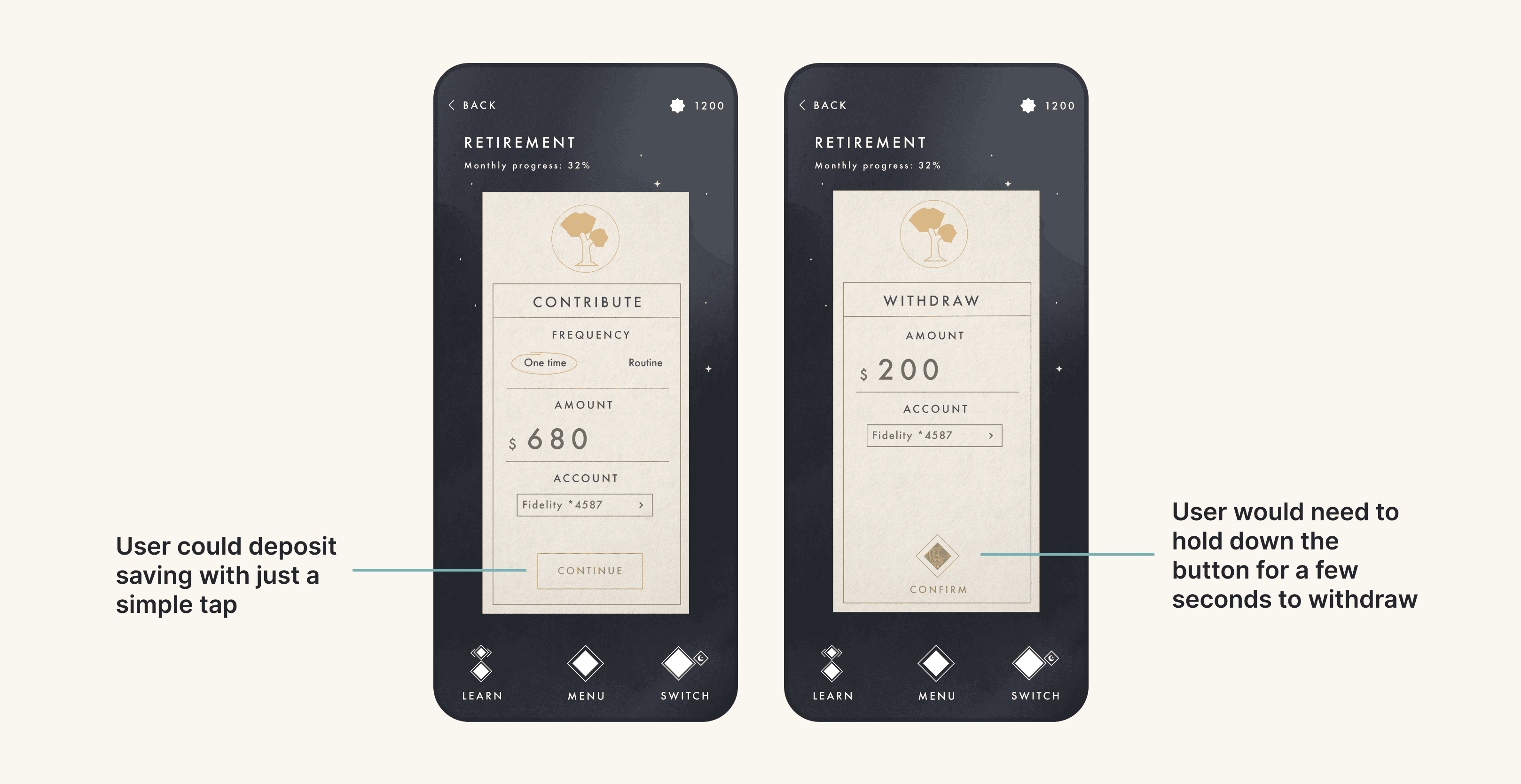

Saving - Easy to deposit, harder to withdraw

Users can easily deposit into their savings with a single tap, whereas withdrawing requires button-holding, providing a reflective pause before proceeding.

Reward - Use rewards to create a balance between spending and saving

By reviewing their spending and saving, users can earn star and use them to purchase travel rewards, allowing them to still enjoy the now and go on meaningful experiences.

(It may take a few seconds to load the video)

Please look on a tablet or desktop for the most optimal user experience!

OVERALL DESIGN PROCESS

A process that is rooted in context and stories

PROBLEM SETTING

There is a retirement crisis due to the lack of household savings and early planning

A significant number of US households retire without significant wealth. While early retirement planning can alleviate this issue, it is often ignored by most young adults—66% of whom have no savings in their retirement accounts.

HYPOTHESIS

Assuming young adults find finance boring and don't see the point of retirement planning

To reduce bias and make better decisions, the team identified several pre-research assumptions. One key assumption was that young adults find finance boring and that they don't need to worry about retirement because it is irrelevant to their lives.

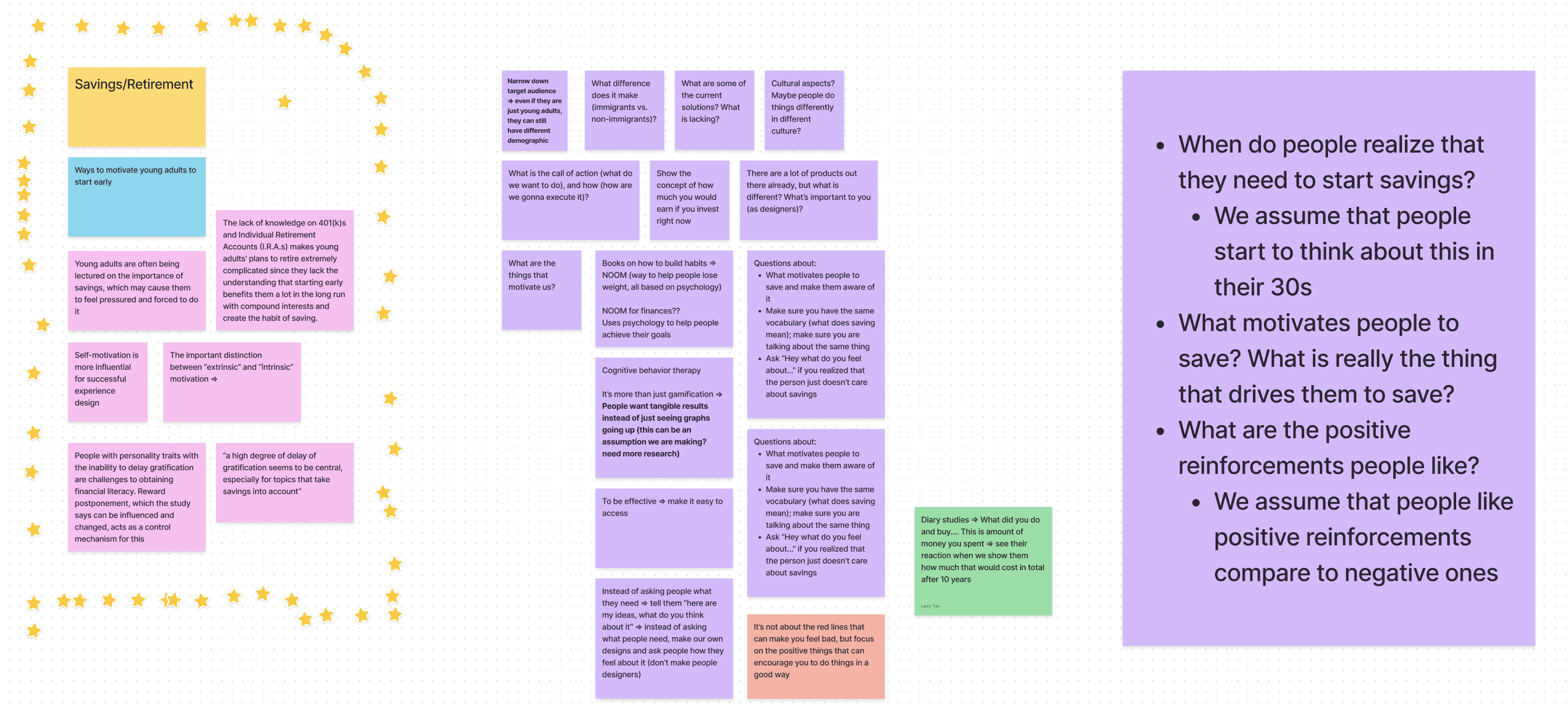

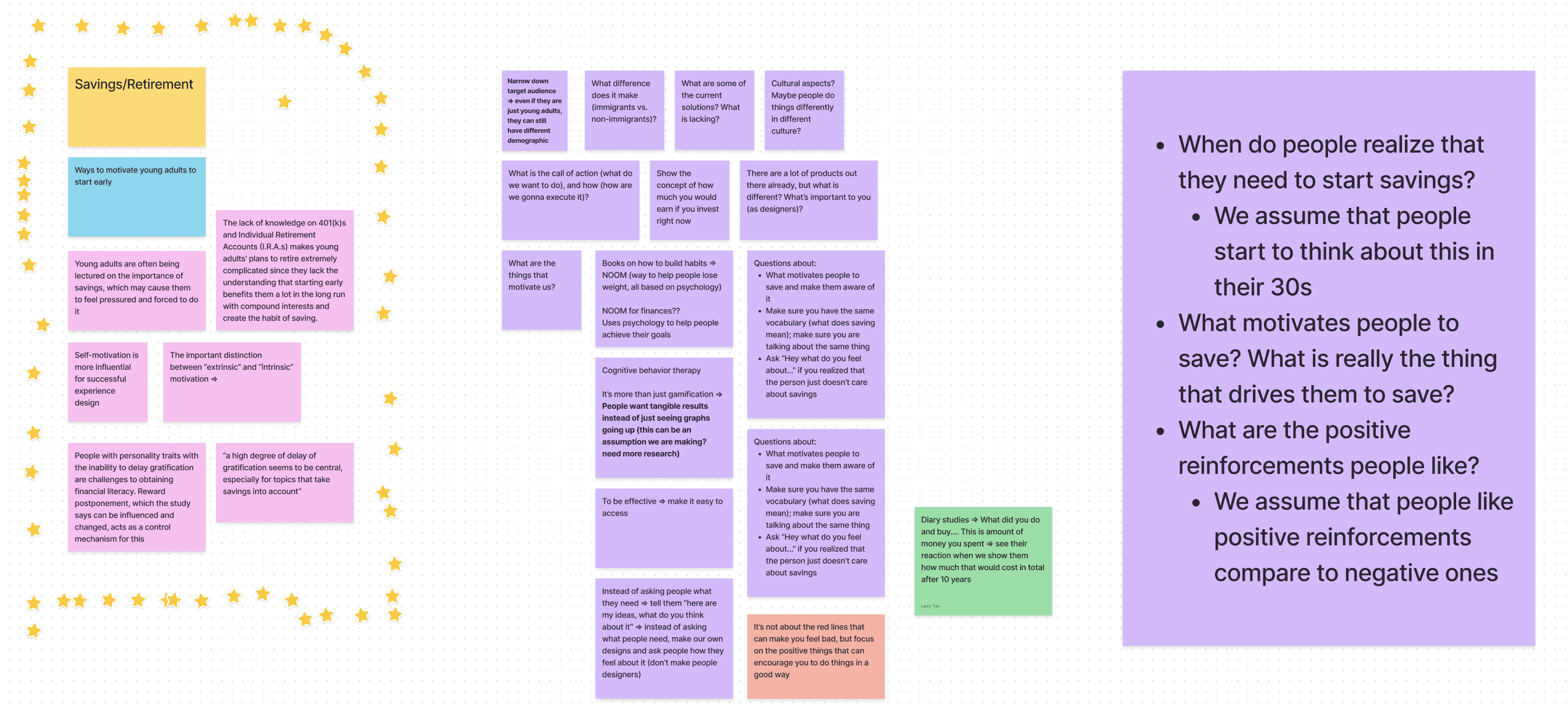

DESK RESEARCH

Understanding the motivators of young adults and how they learn about saving

I wanted to validate our team's assumptions about young adults' limited focus on savings, so I conducted literature reviews on the psychological drivers of young adults' savings behavior, as well as their methods of learning saving-related information

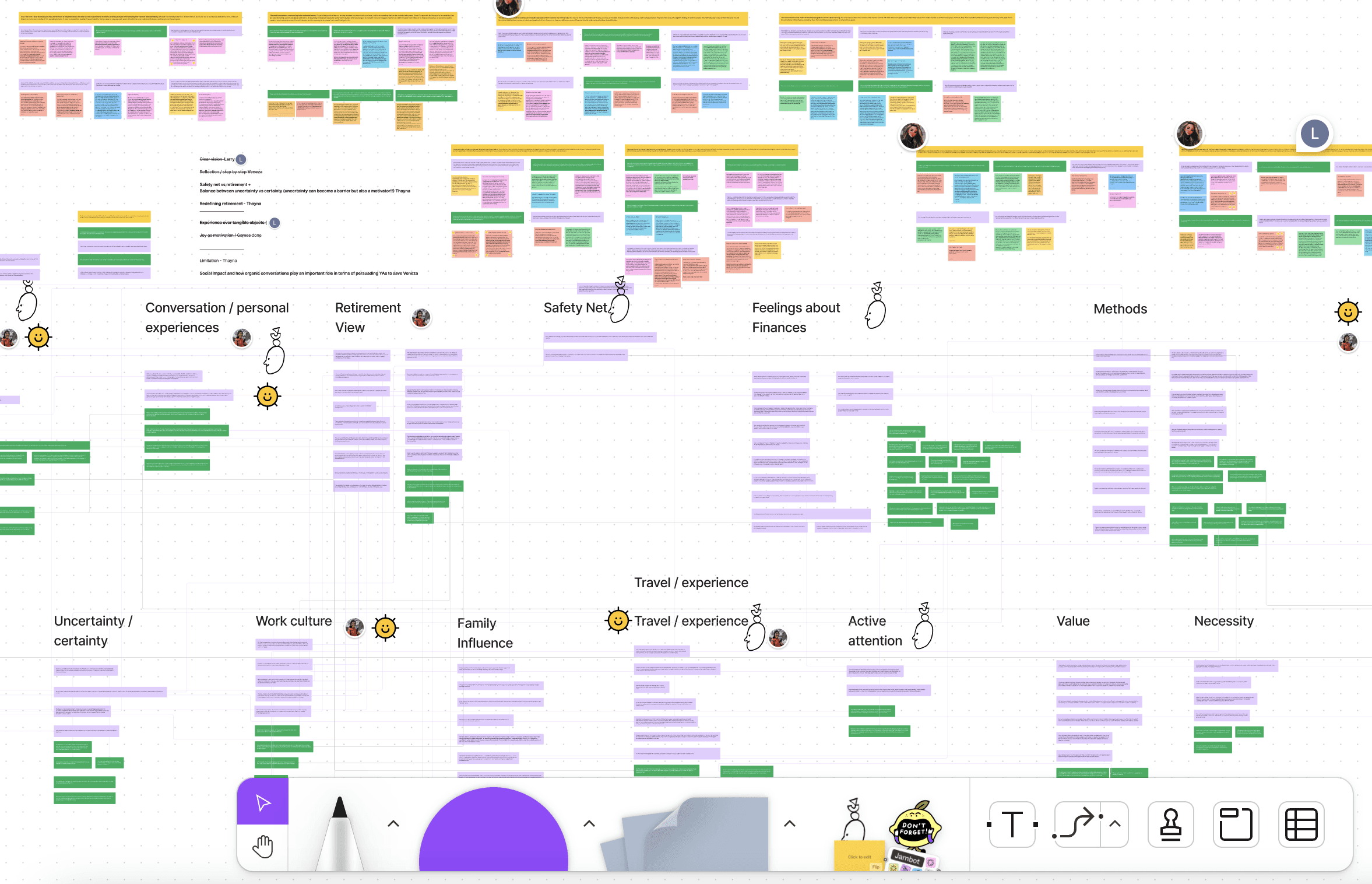

The team summarized our findings in FigJam and identified unanswered questions

FINDINGS

Lack of understanding and external pressures are causing young adults to overlook retirement

I found that young adults frequently lack knowledge about retirement savings and are encouraged to save without understanding the financial concepts such as compound interest. This causes feelings of overwhelm and pressure, leading them to overlook the benefits of retirement savings.

A lack of knowledge about 401(k)s is preventing young adults from planning for retirement

Young adults commonly receive lectures about savings, resulting in pressure and a sense of obligation

Extrinsic motivation is less effective than intrinsic motivation for long-term task completion and goal achievement

RESEARCH

Identifying the issue

Based on our secondary research, we formed an assumption that young adults find finance boring and don't see the point of retirement planning because it is irrelevant to their lives.

10

interviews with young adults + SMEs

5

cultural probes with young adtuls

4

competing products evaluation

4

rounds of qual data analysis

FINDINGS

Our research confirmed young adults' views on savings and provided deeper insights

interviews with young adults + SMEs

interviews with young adults + SMEs

STAKEHOLDER MAP

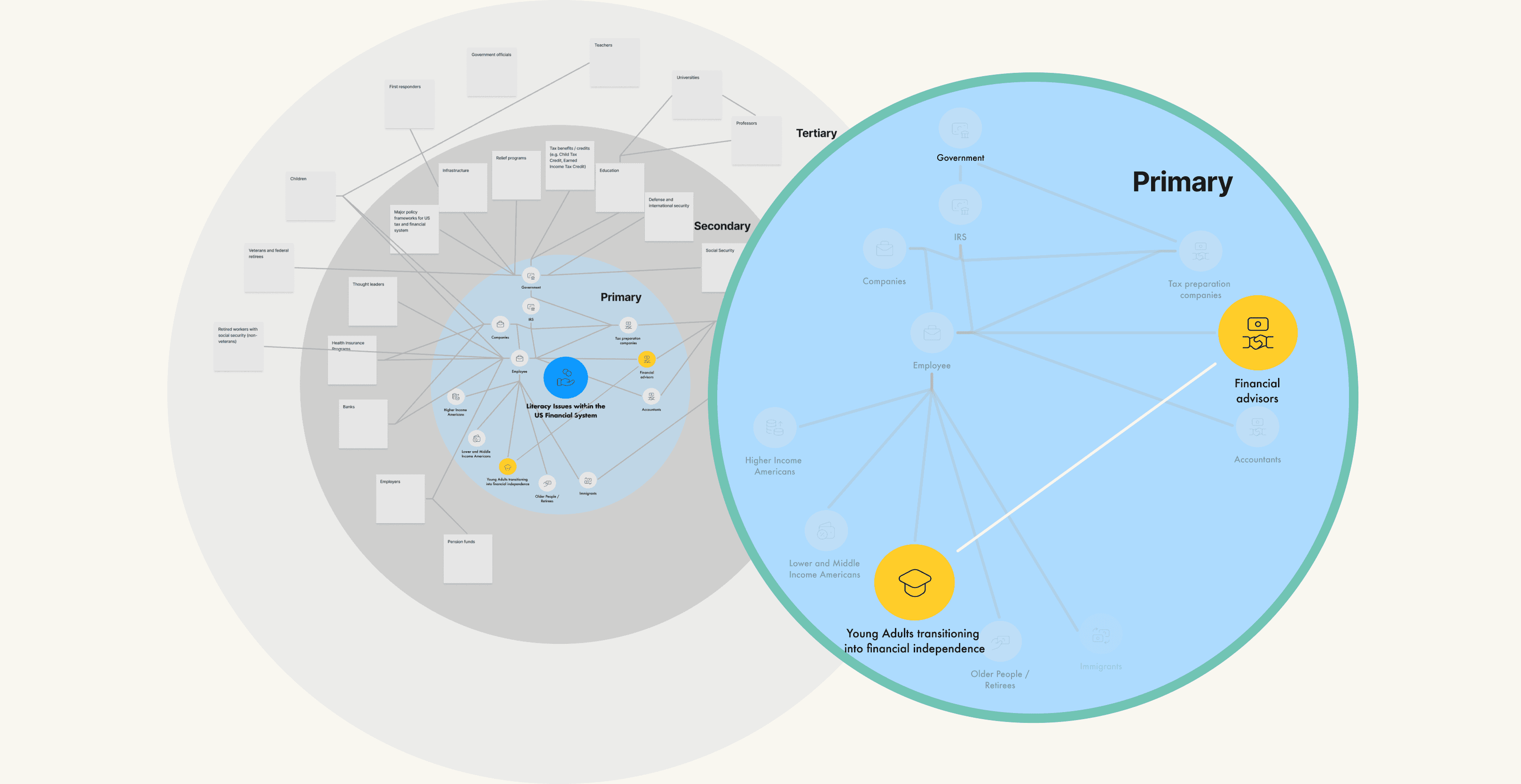

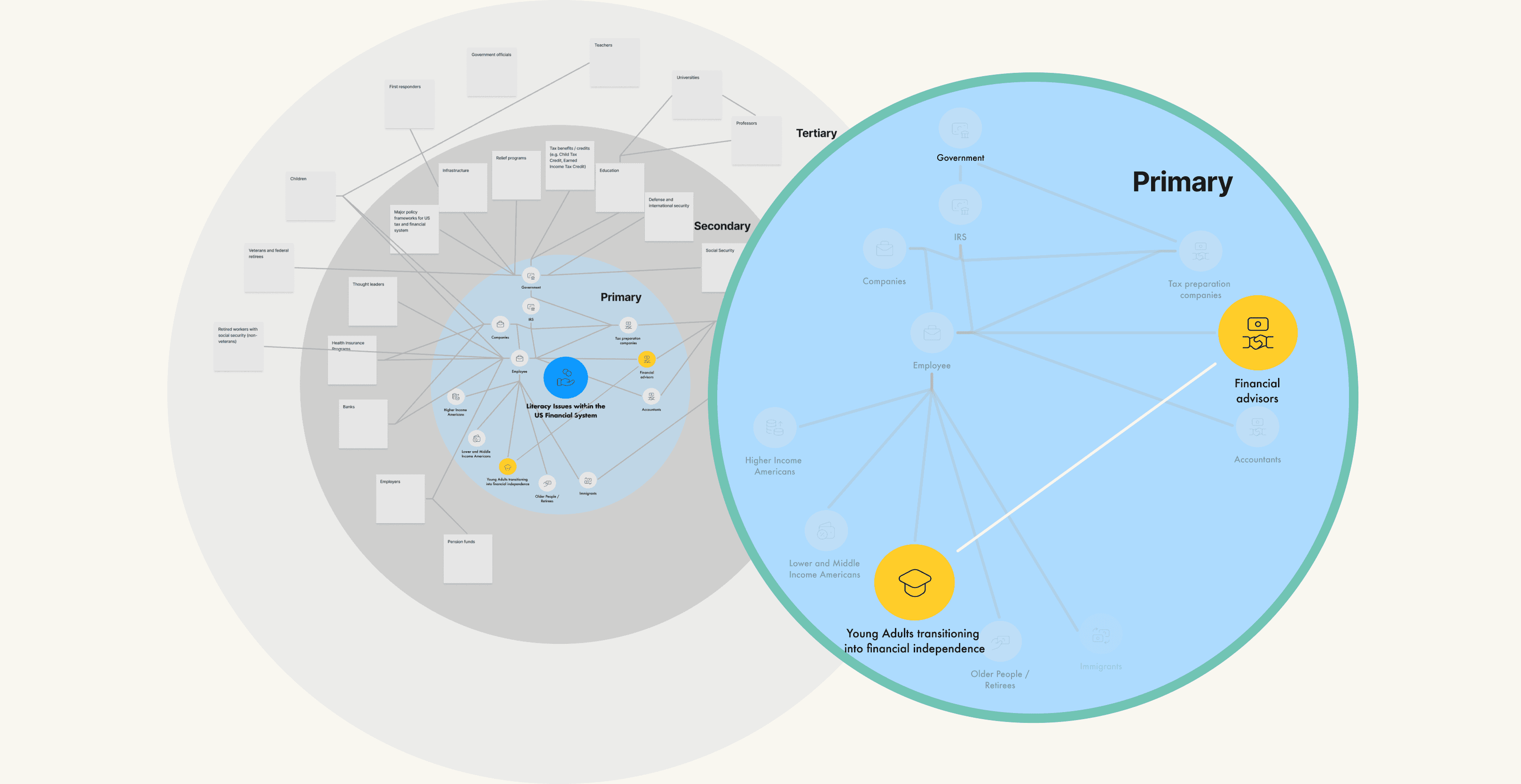

Narrowing down our primary stakeholders to young adults and financial advisors

With the limited time and resources available, my teammates and I created a stakeholder map and selected financial advisors and young adults as our research focus, assuming they are the most related to and familiar with the problem space.

We identified all of the primary, secondary, and tertiary stakeholders, as well as their connections in our stakeholder map

USER INTERVIEWS & CULTURAL PROBES

Understanding Young Adults’ Perceptions and Behaviors with Savings and Retirement

I collaborated with my team to shape research questions and develop a plan. I moderated five interviews, co-moderated five more, and handled note-taking for the remaining sessions. Additionally, I led the data analysis to uncover potential insights that would drive our team forward.

What we wanted to learn:

How do young adults perceive retirement?

What are the barriers or enablers to saving?

Who we learned from:

Young Adults

Aged 18-29

Financially independent

Earning at least the medium income for their location

Not full-time students

Financial Advisors

No specific criteria (Goal was only to understand the problem space from a professional's perspective)

How we did it:

Semi-structured interviews

5 Financial Advisor

understand professionals' perspective

5 Young Adults

understand young adults based on what they say by asking them what they would do if they suddenly had $10000

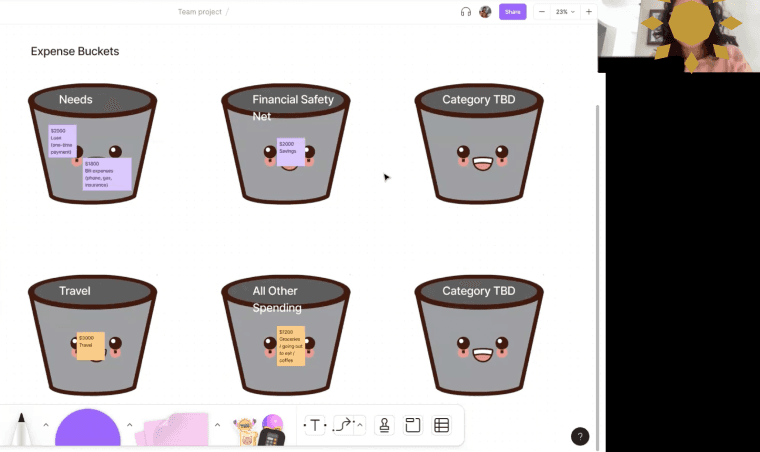

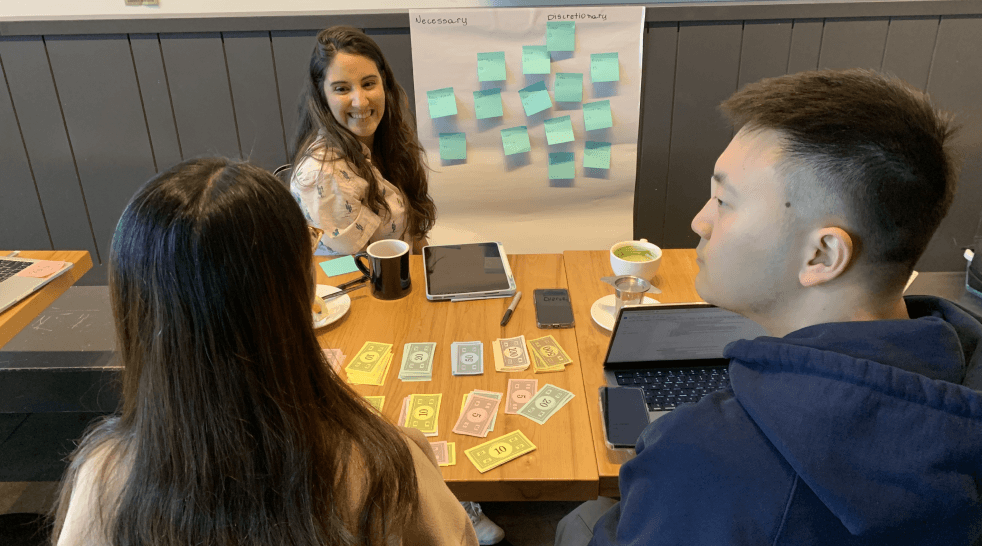

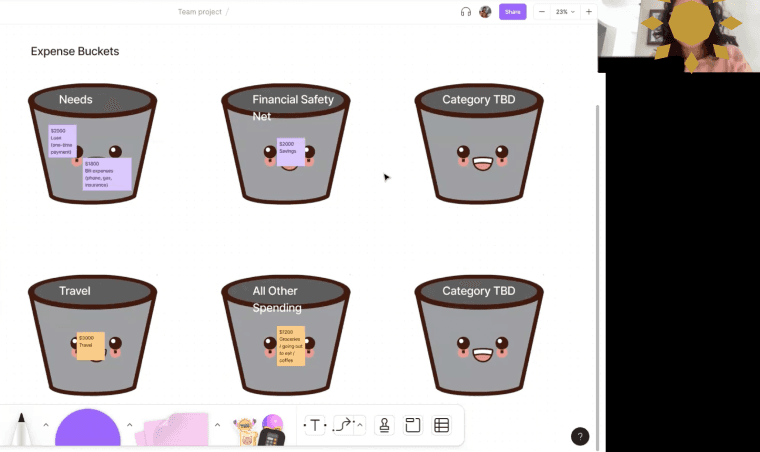

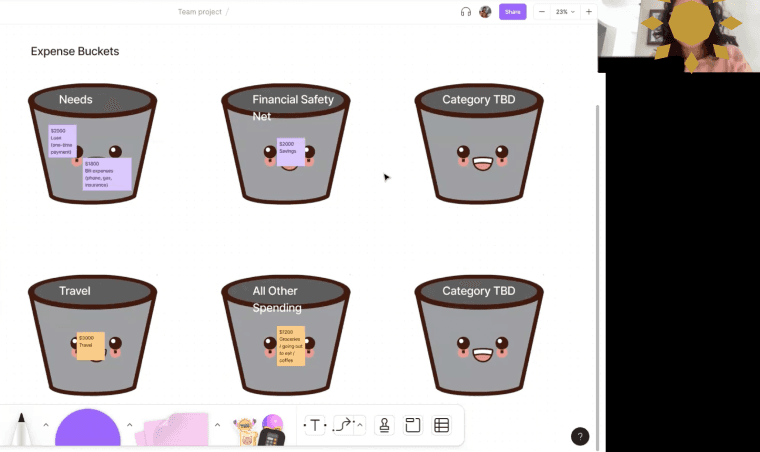

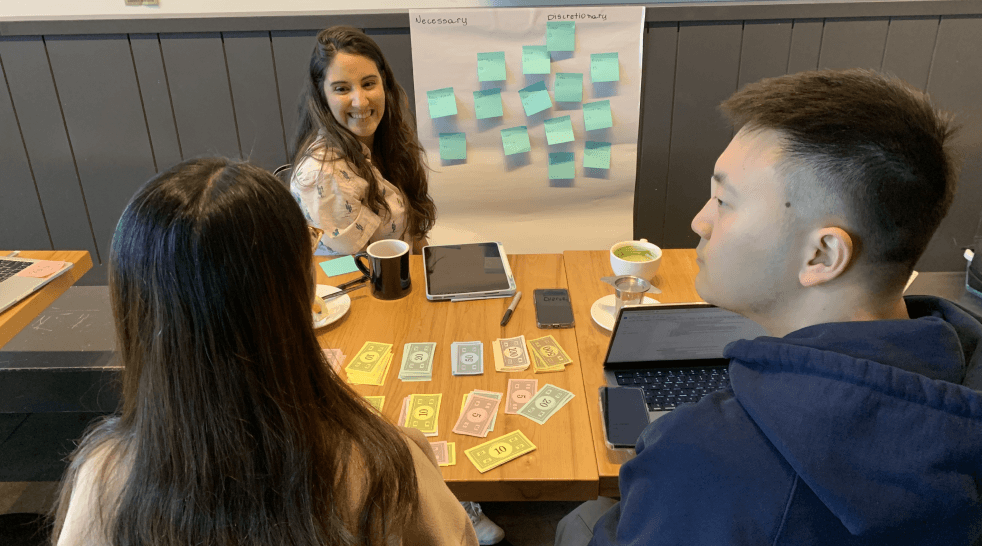

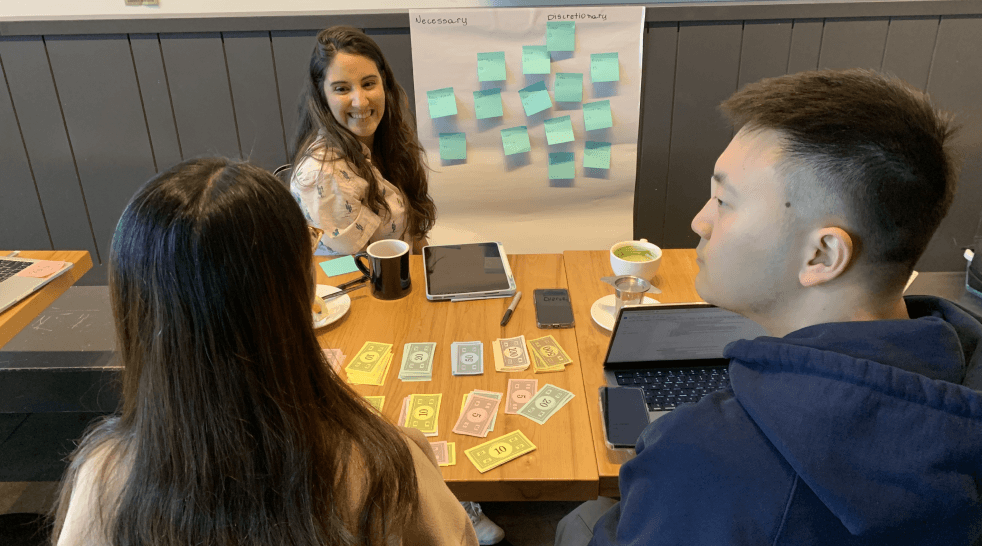

For the interviews, we asked our participants to list and categorize what they would do if they had $10000

Probe Activities

5 Young Adults

Understand young adults based on what they do by asking them to review and reflect on their past spendings

For the probe activities, we asked our participants to review their spendings in the past 7 days and categorize them

FINDINGS

Young adults often perceive saving as a hindrance to their current lifestyle and need a clear financial vision to recognize its value

Young adults often view saving as an obstacle to their current lifestyle, requiring a clear financial goal to understand its value; however, viewing it as a means of securing their future bridges the gap between a safety net and retirement, motivating them to prioritize long-term financial stability.

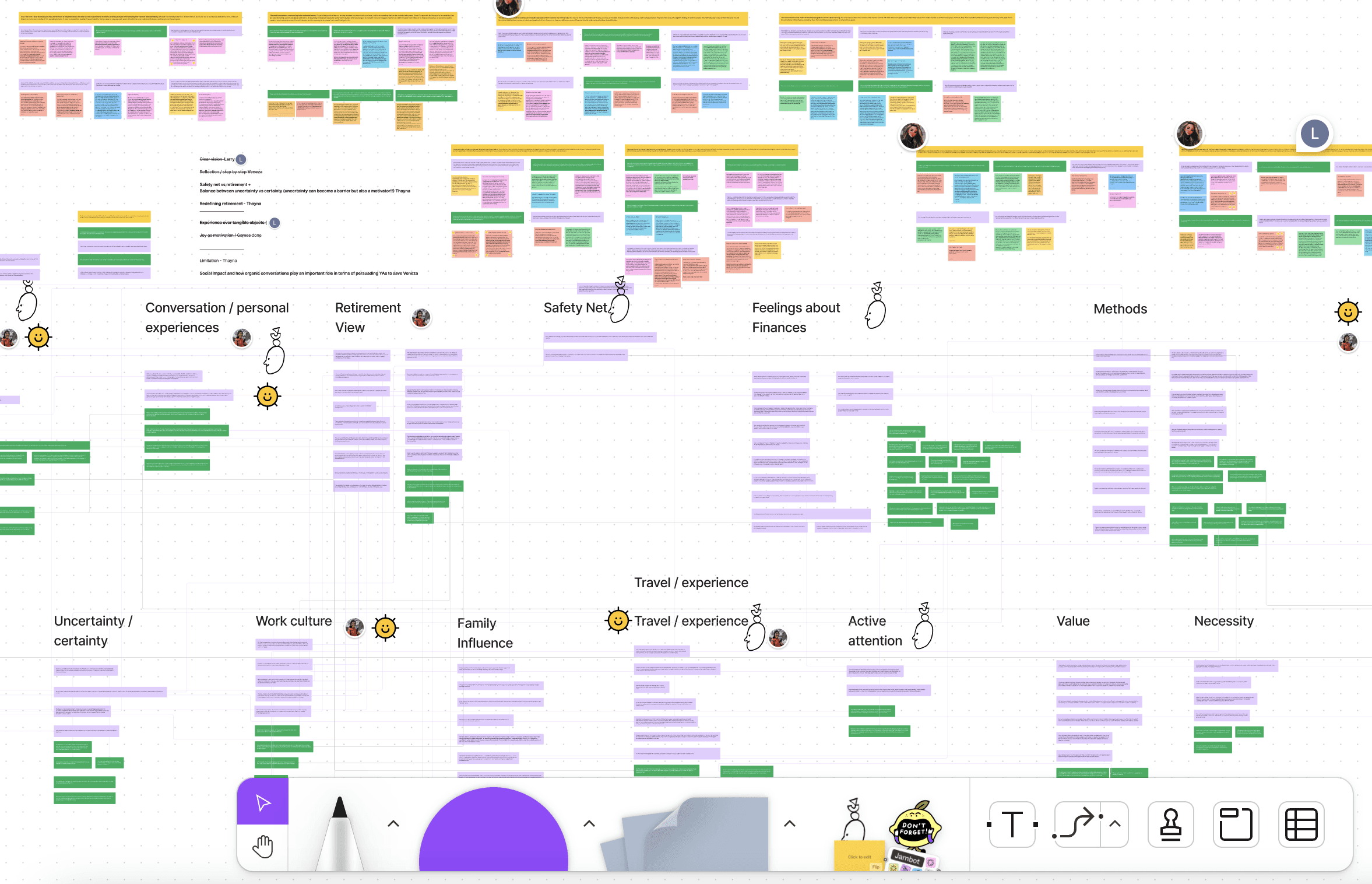

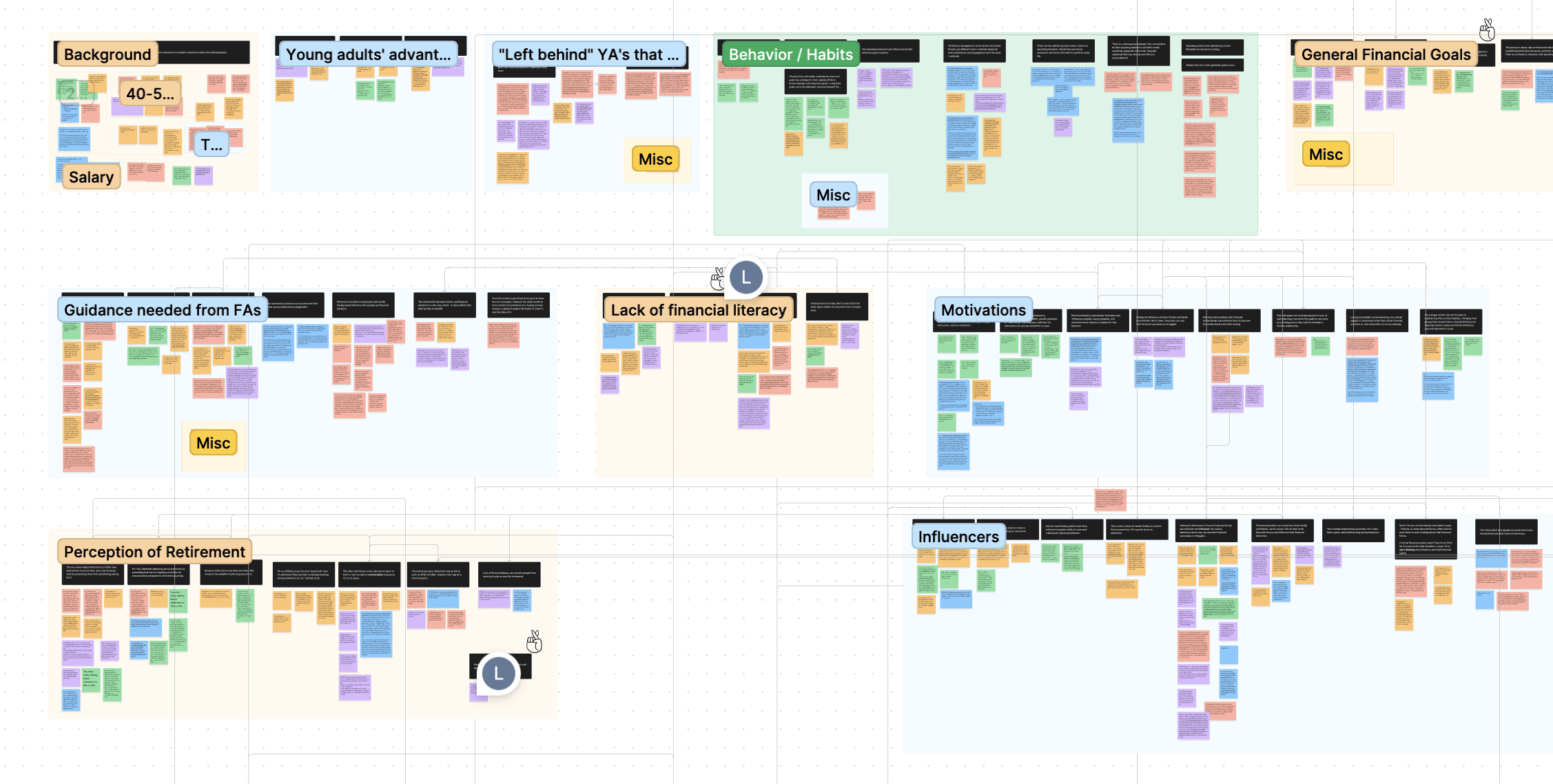

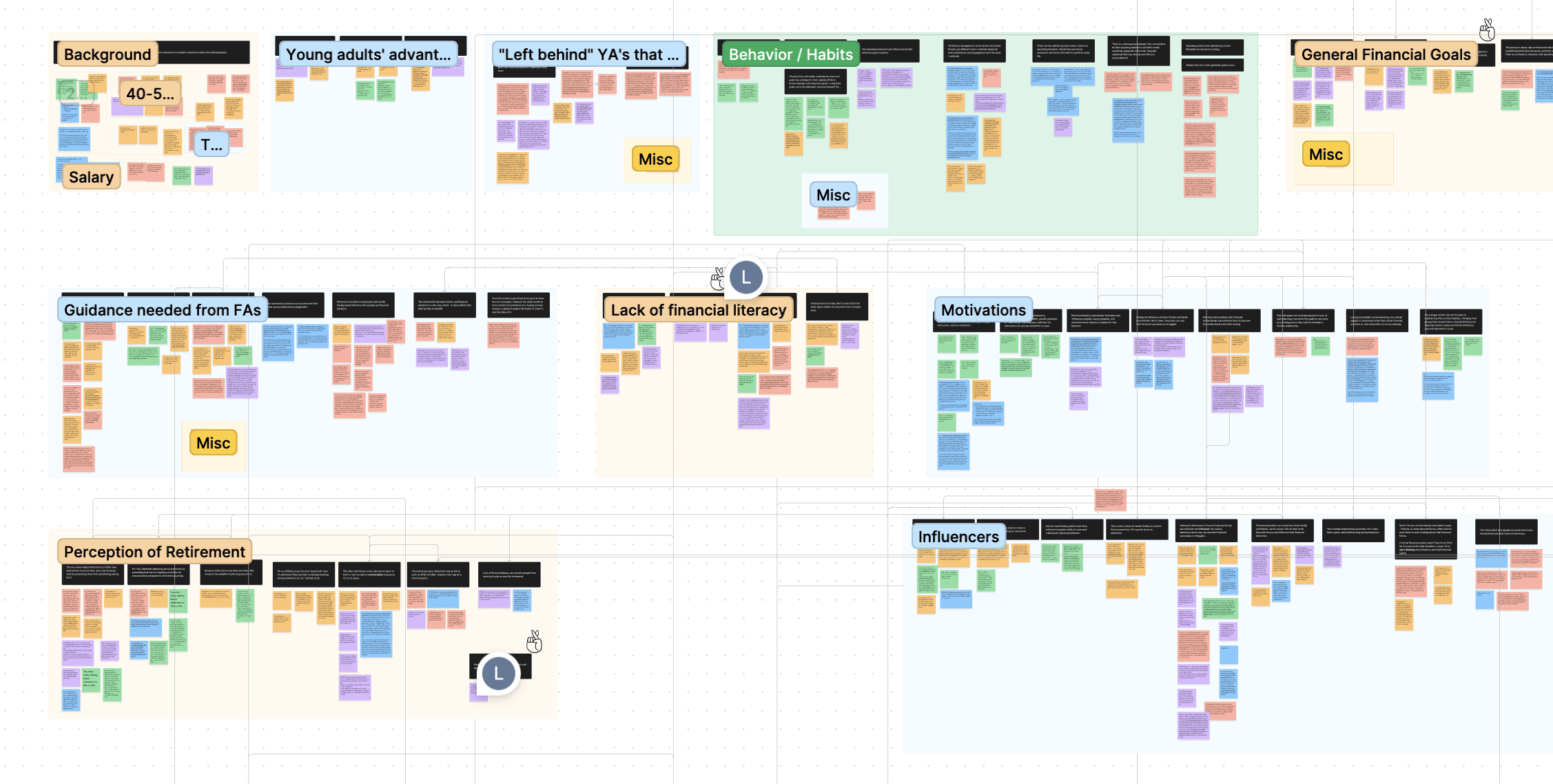

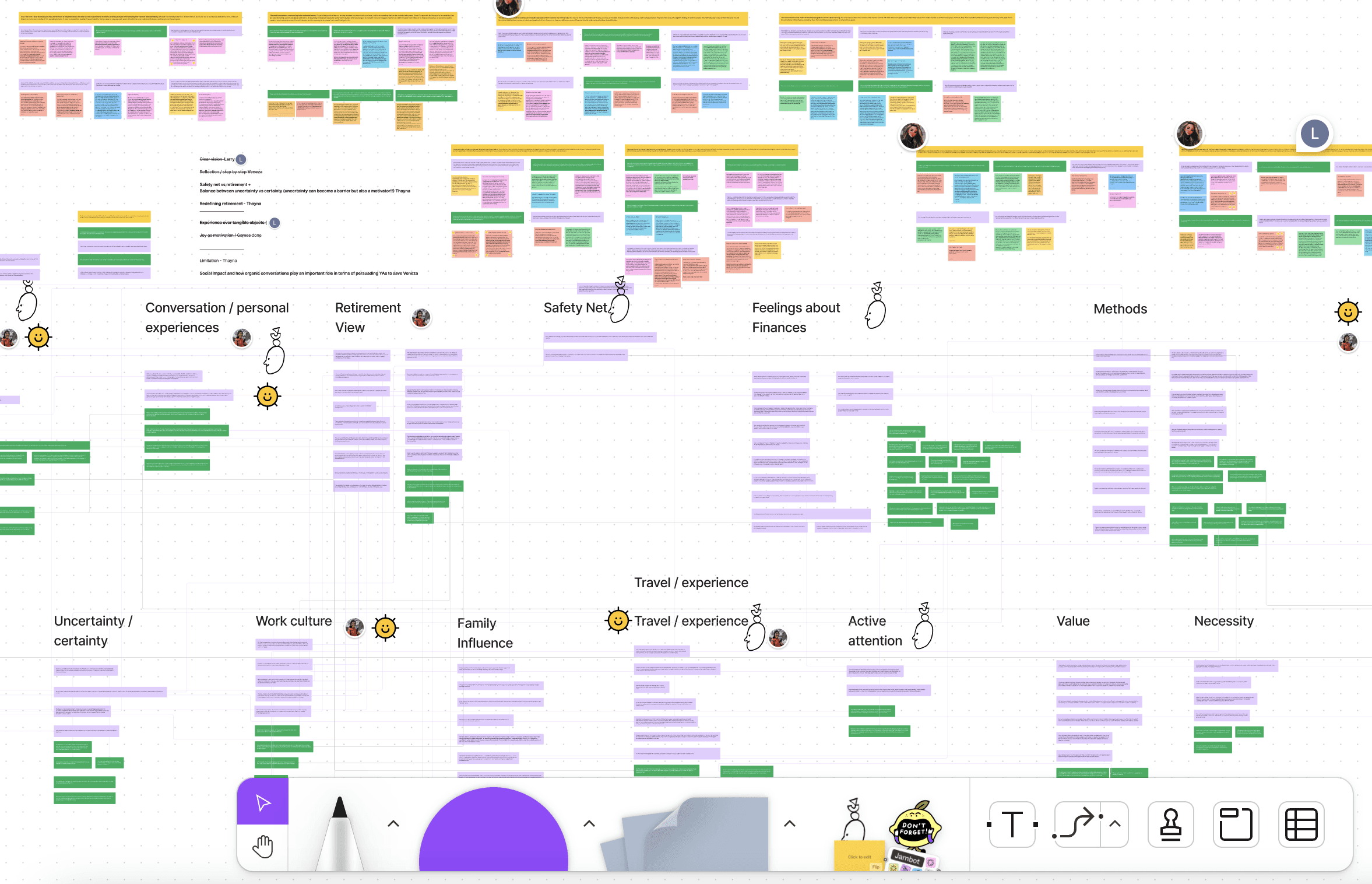

We analyzed our data from 15 different participants using affinity diagrams, with each black sticky representing a finding

We then connected all of our findings from young adult (purple stickies) and financial advisors (green stickies) and categorized them to identify insights

Other Findings:

Clear financial goals prompt young adults to reflect on the step-by-step requirements for success and financial stability

Viewing savings as a path to future security links young adults' notions of a safety net and retirement, motivating them to save

Showing young adults a future retirement where they can pursue their hobbies and interests can encourage them to save

Past and future experiences influence how YAs justify their financial decisions and behaviors.

COMPETITOR ANALYSIS

Recognizing the strengths and weaknesses of our competitors

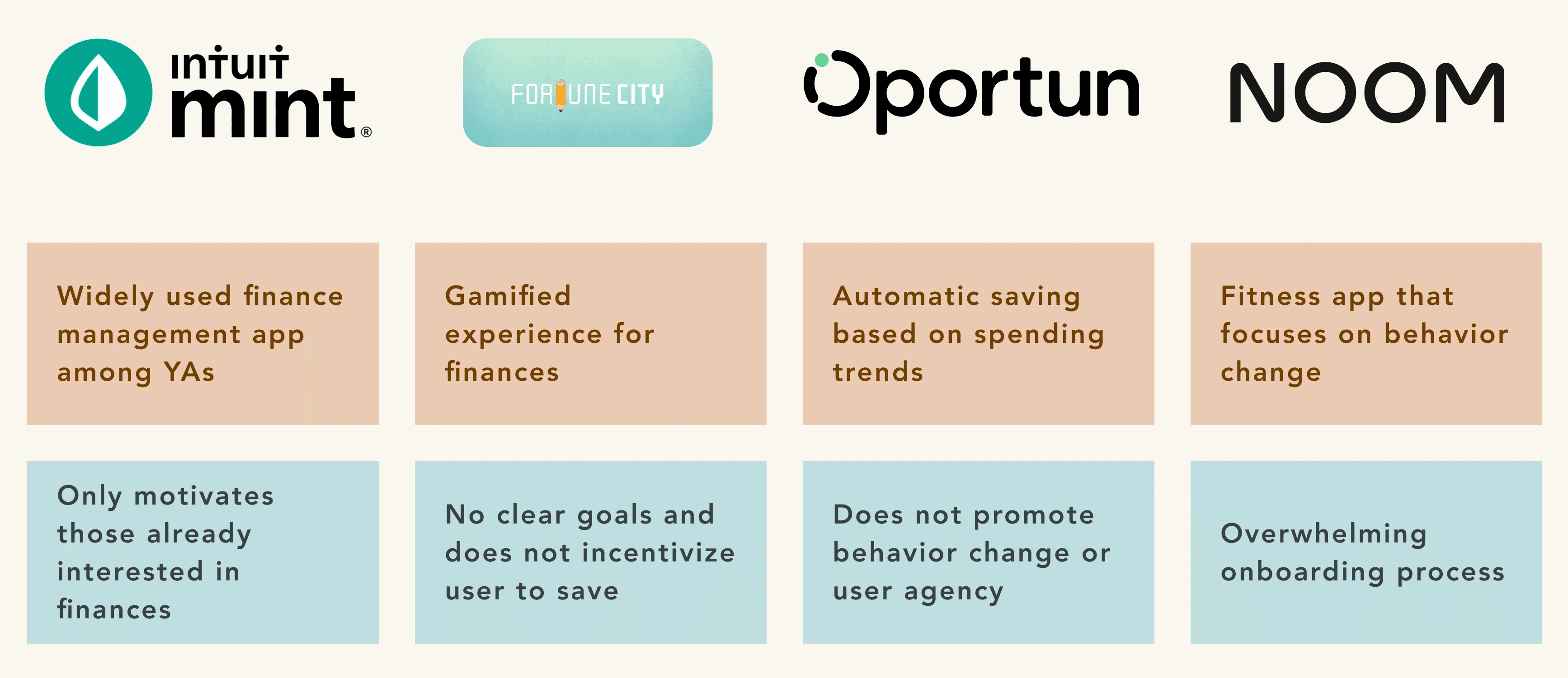

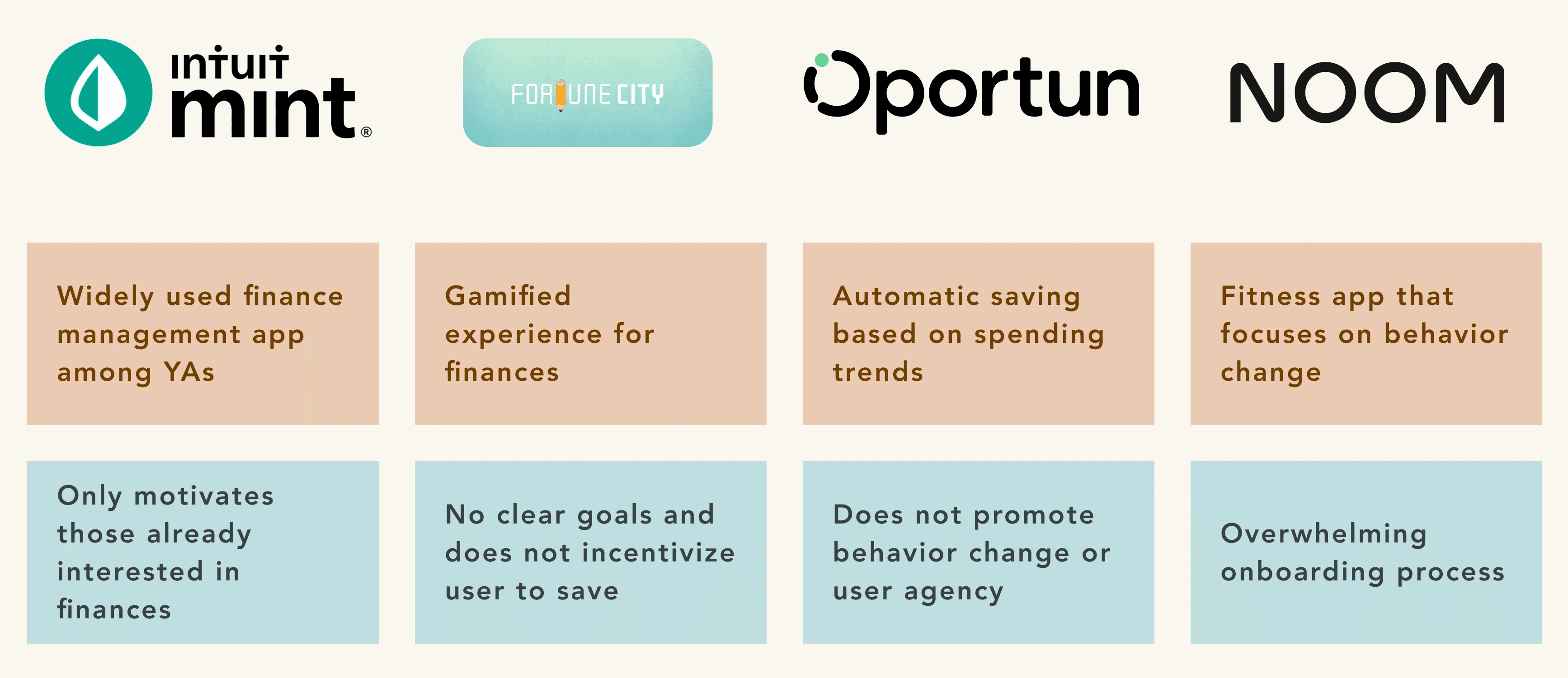

Having learned from desk research that intrinsic motivations are more effective, I suggested conducting a competitor analysis with apps like Noom and Mint, and we identified our focus on behavior change and gamified experiences in our design.

The pros (red) and cons (blue) our team identified through competitor analysis

Design Challenge

How might we engage young adults to change their perception about retirement culture and see the value of saving for retirement, by viewing it as a long-term future security and building a clear vision of what that future could look like, so they can take proactive actions towards it?

IDEATION

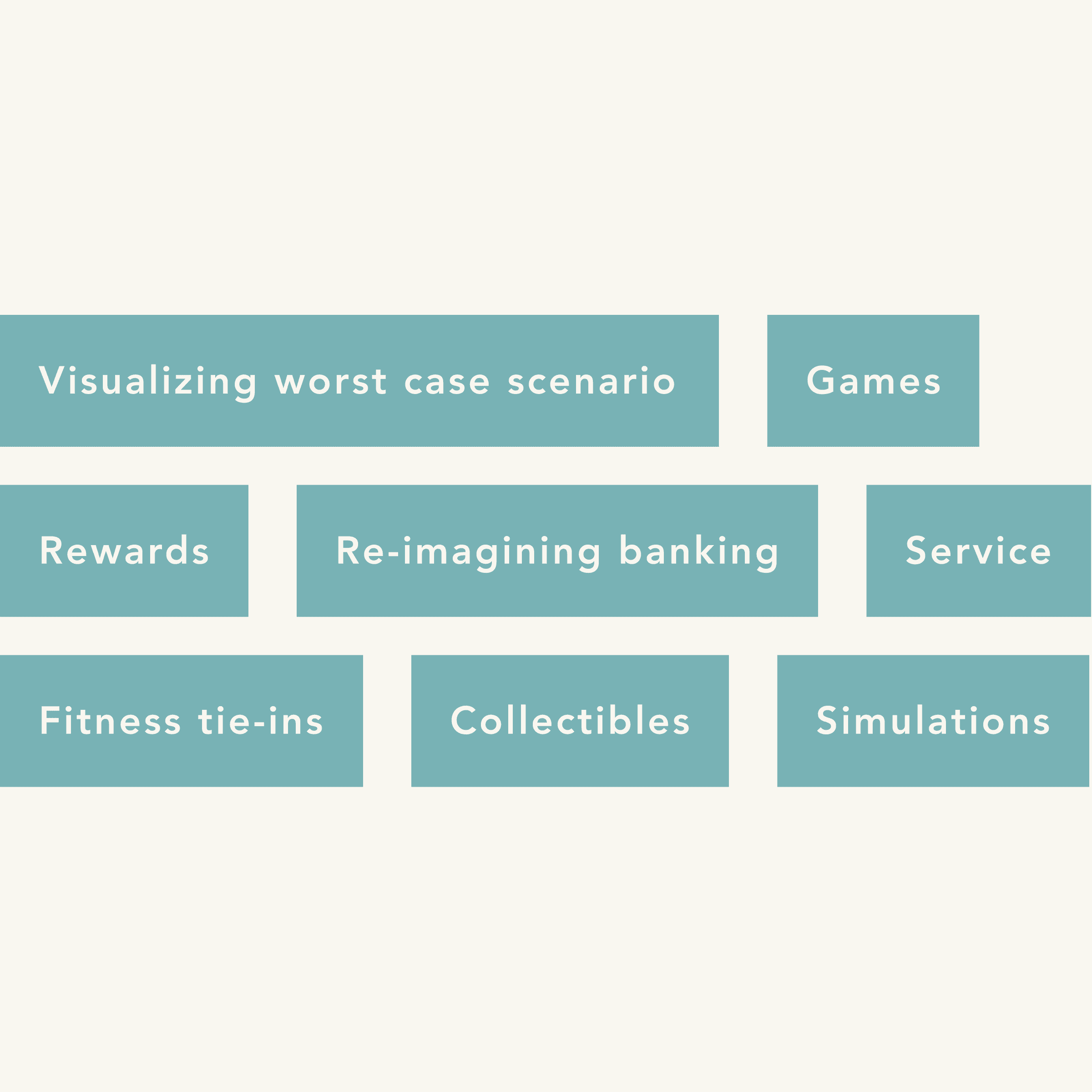

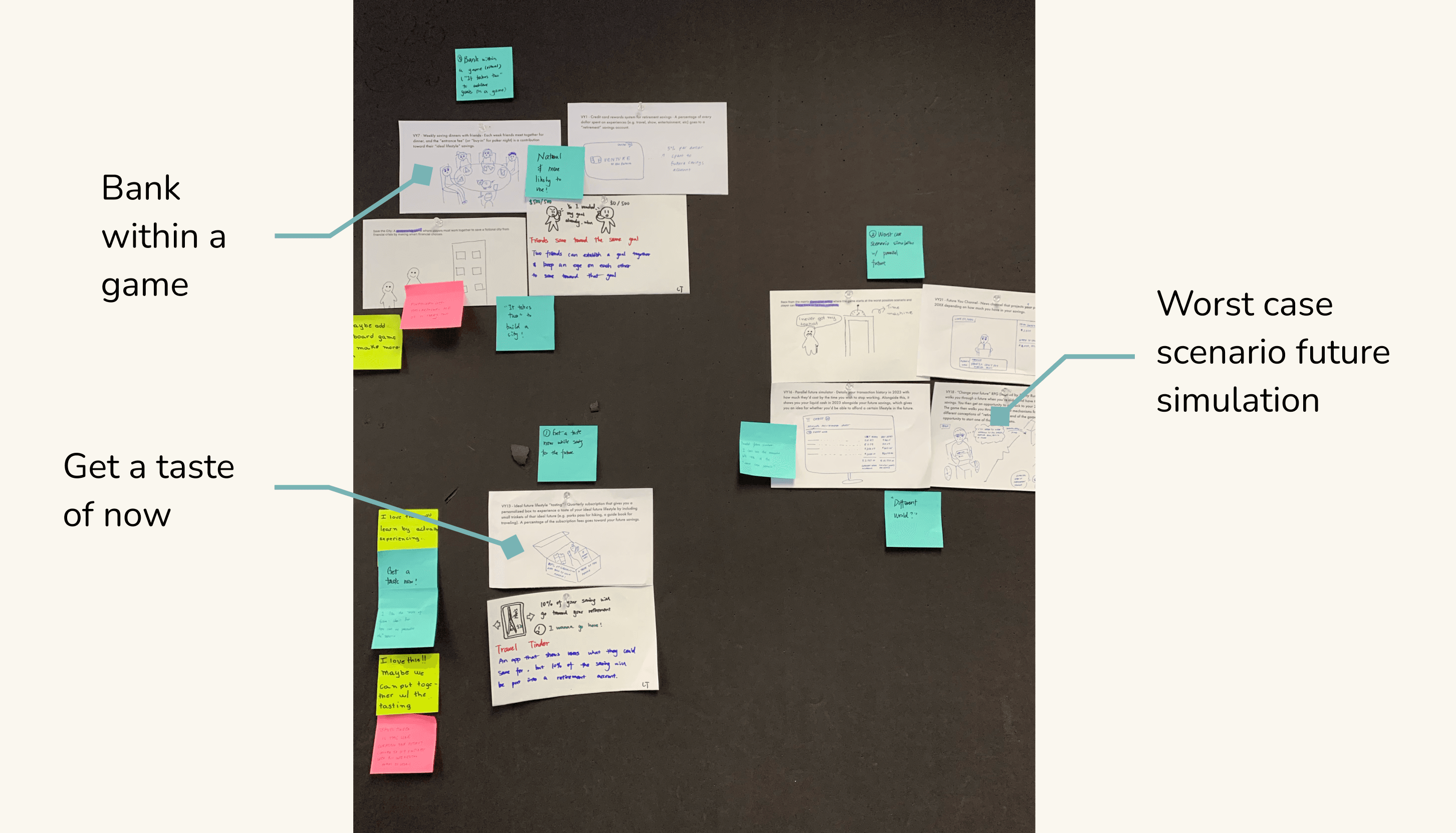

Forming first round of ideation, 79 ideas

Overall, the team brainstormed 79 ideas and classified the overlapping ones into various categories. We then shared the categories with our peers and received preliminary feedback.

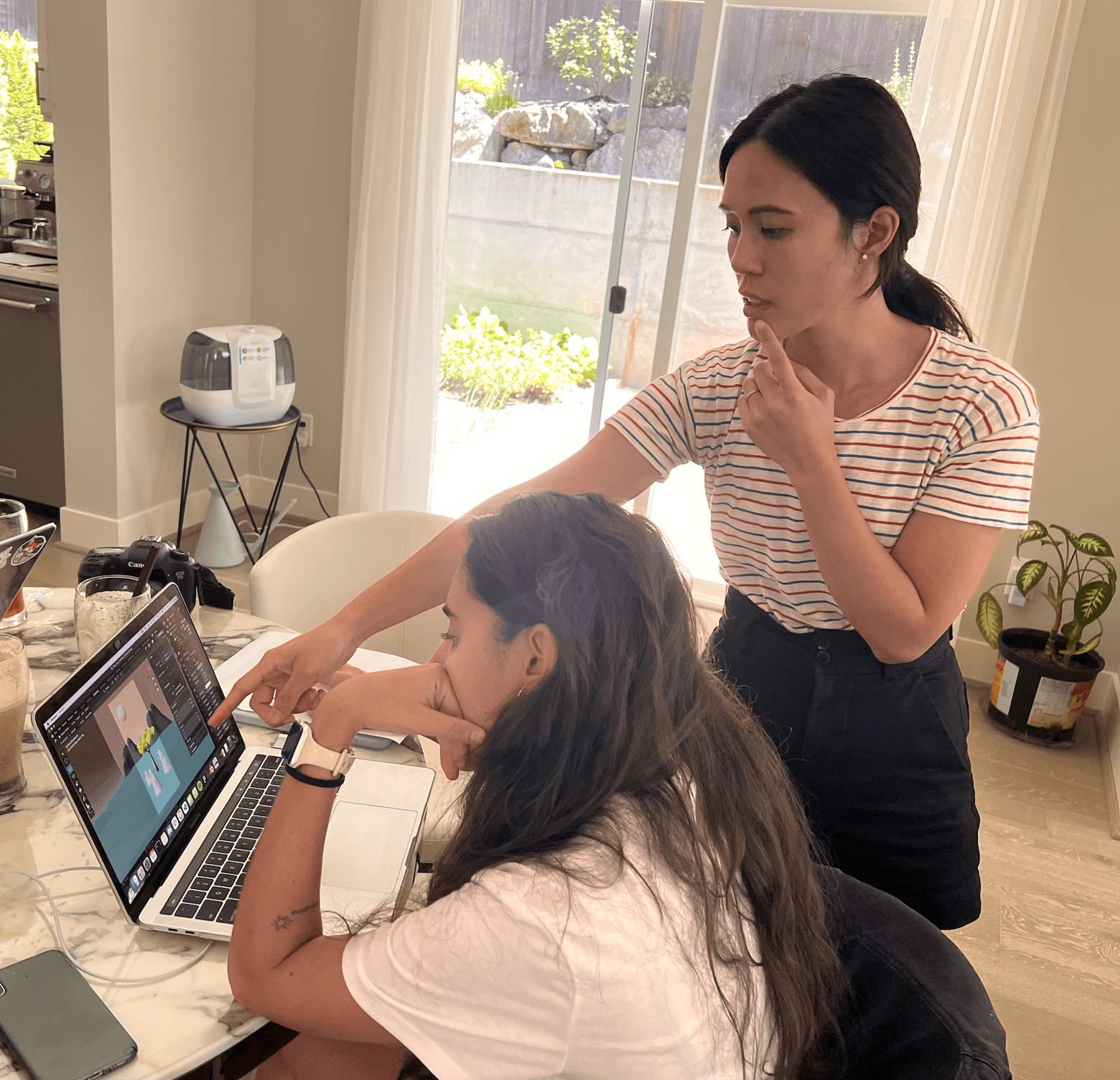

My teammate and I reviewing the feedback we got from our peers

DOWN-SELECTING

Making decisions based on design principles, desired outcomes, and ongoing reflection

Using our research, design principles, and desired outcomes, my teammates and I dot-voted on promising ideas, assessed them for pros and cons, and chose three for deeper exploration through storyboarding.

We listed the pros/cons near each category with the light yellow stickies

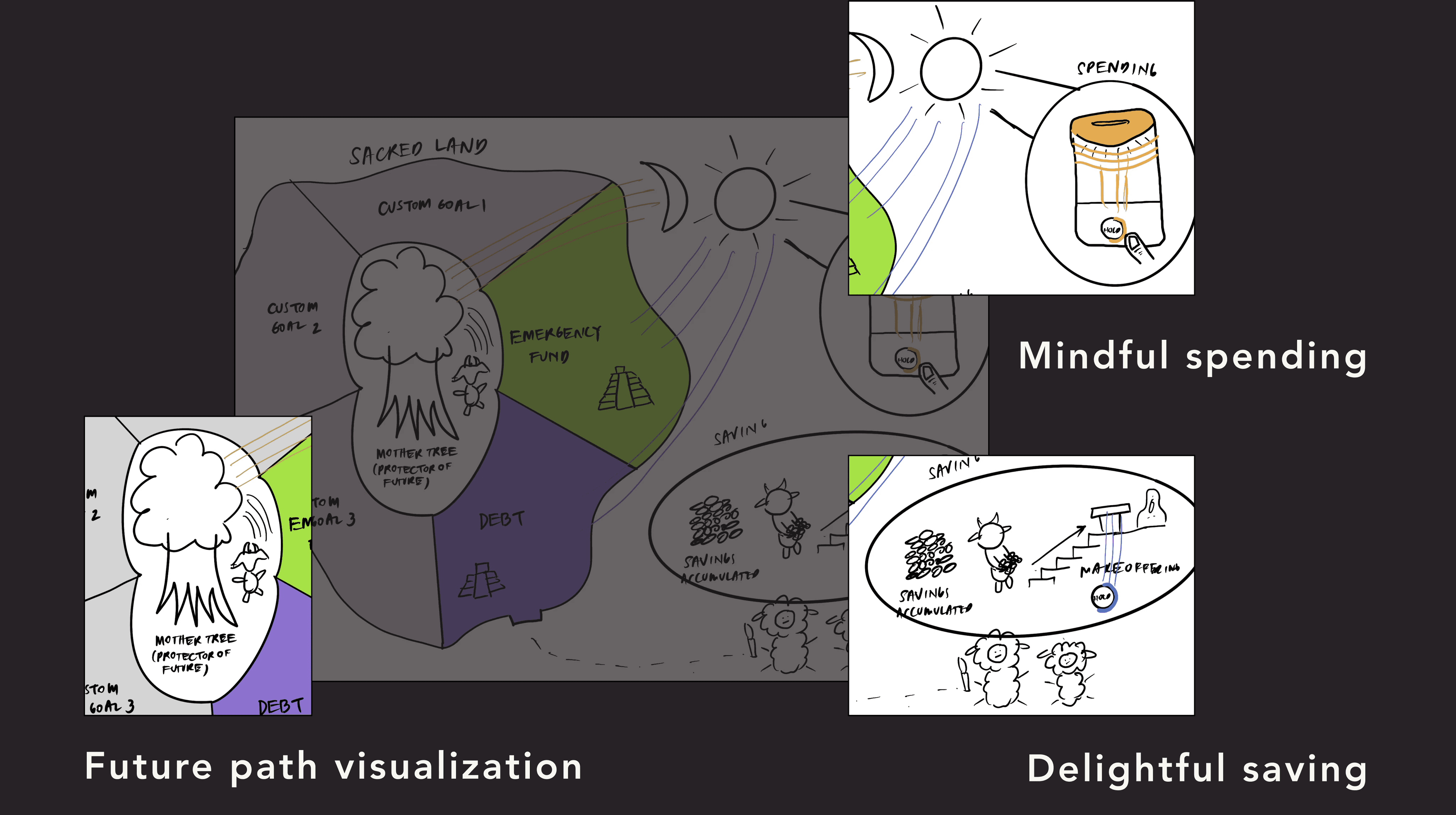

The 3 ideas my team ended up choosing

THE INITIAL CONCEPT

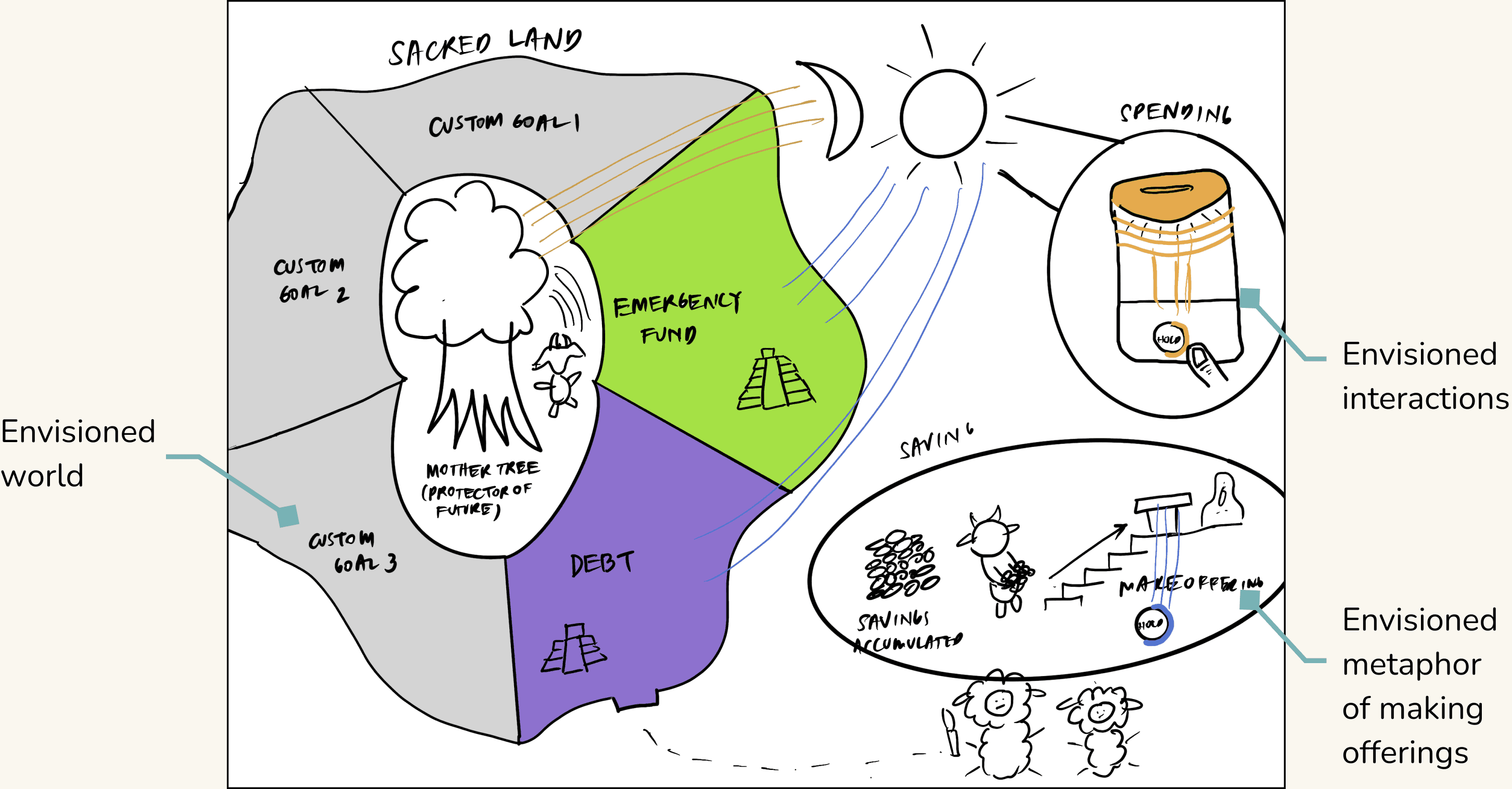

A game that helps young adults in visualizing their future goals and managing their finances

The team discovered that we could merge our three selected ideas into one by creating a finance management game with a "money tree" guarded by goats symbolizing savings.

Our initial concept

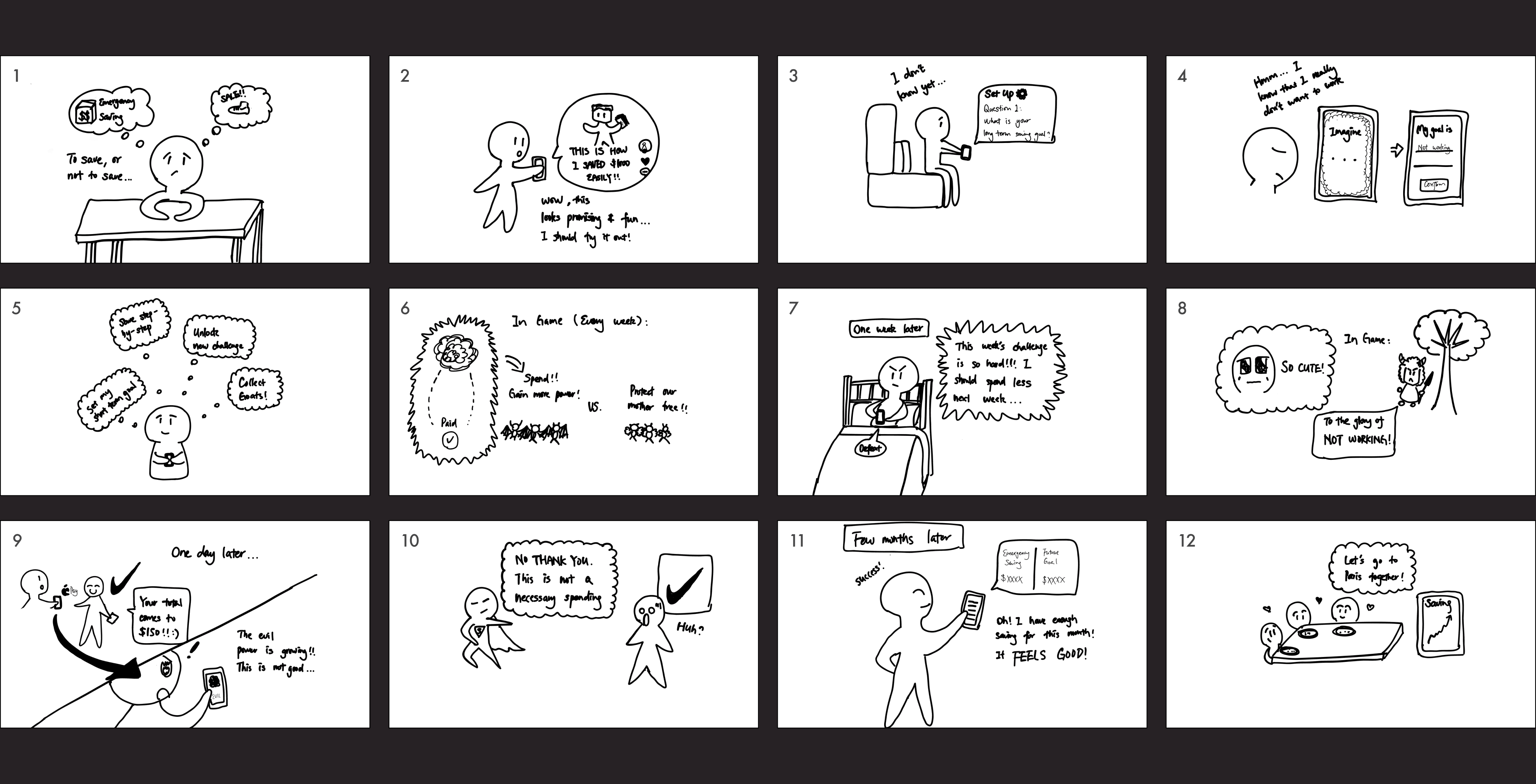

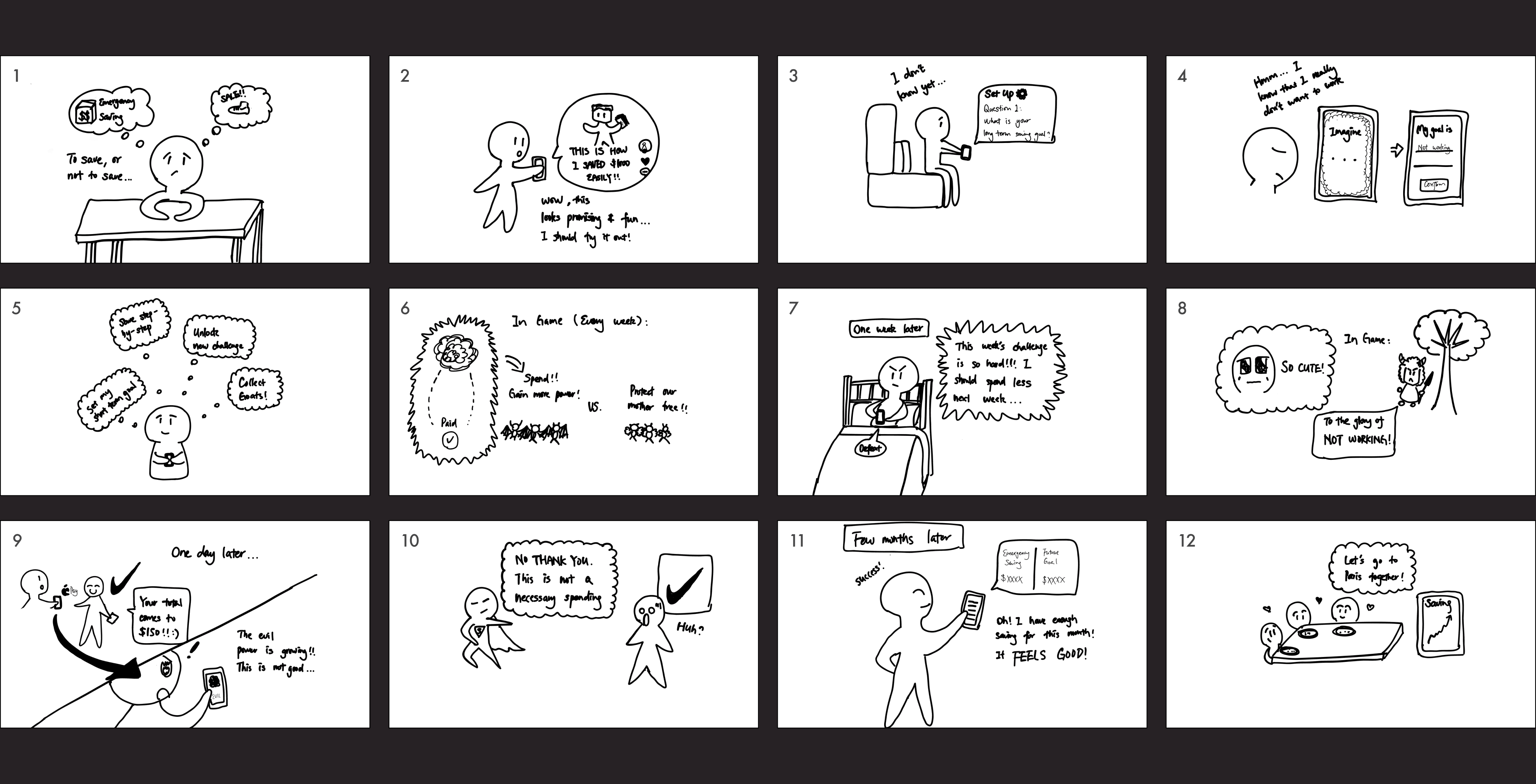

STORYBOARD (V1)

Trying to understand the design in context but realizing that something isn't quite right…

After creating multiple versions of our first storyboard, we realized that the design lacks a reason for "why people would use it in their lives," and our promising idea no longer appears to be so promising…

Our initial storyboard (V1)

...gamification for the sake of gamification..."

The feedback from our advisor highlighting our pain point

PITOVTING

Shifting the focus to create an engaging finance app that inspires real financial actions among young adults

I proposed to shift our focus to key interactions and connect our design with our research to reflect on why this design is needed. We refined the design through another rounds of discussions and decided to focus on designing a finance app with engaging features.

The key interactions we decided to keep from our original design

STORYBOARD (V2)

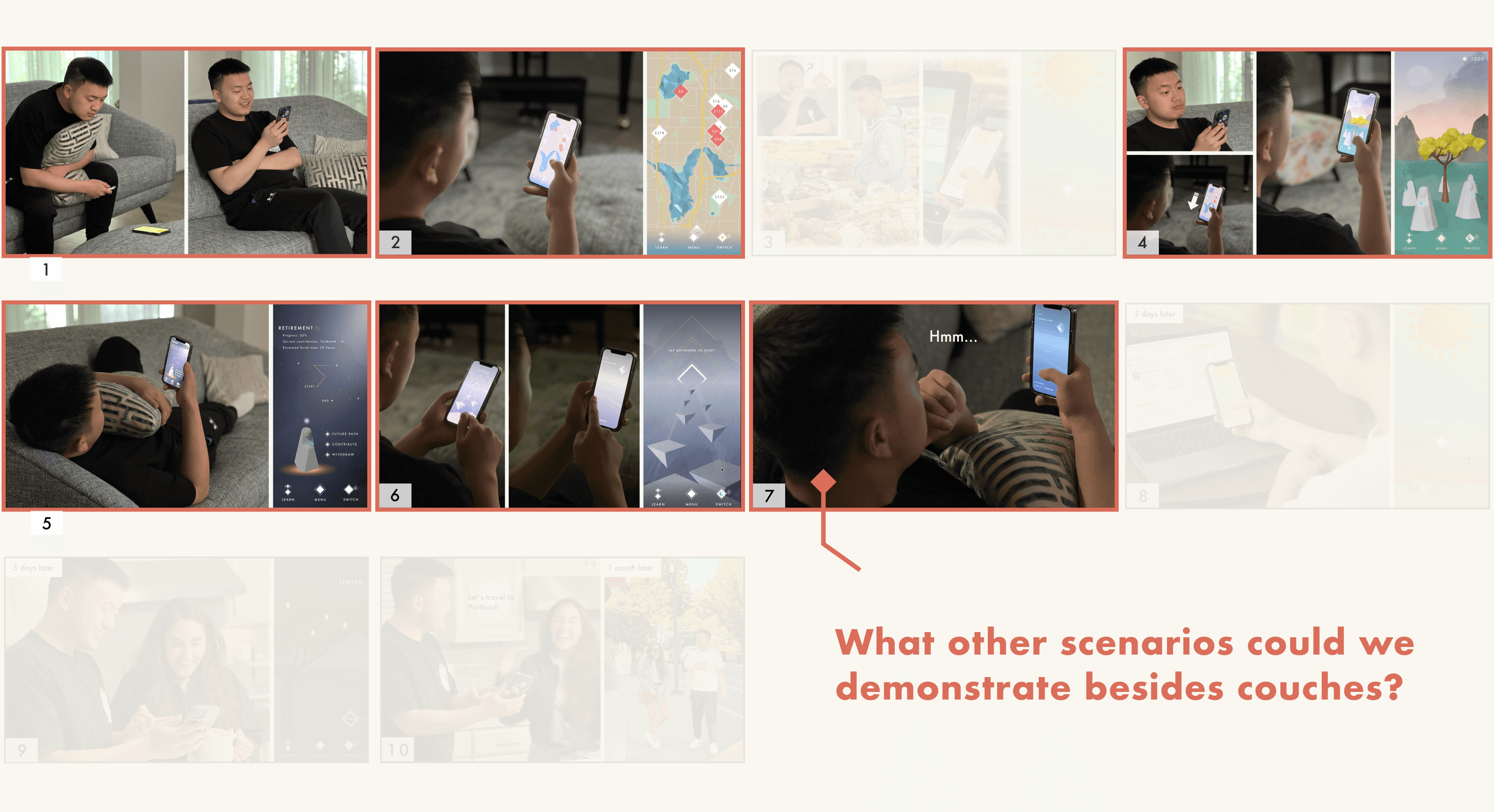

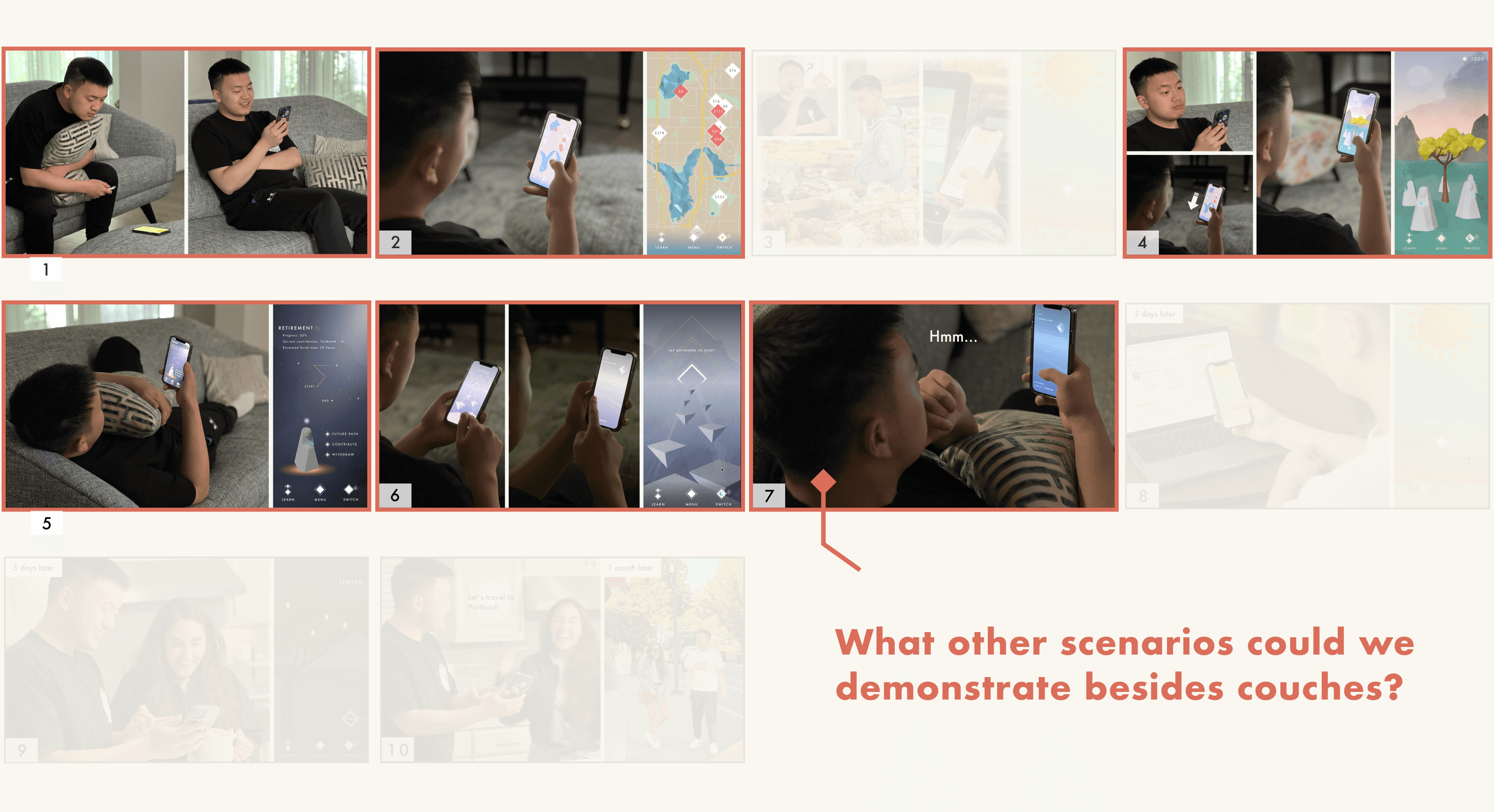

STORYBOARD (V2) & PROTOTYPING

Refining the design through storytelling

The team integrated interactions into a cohesive finance management tool, and we created user stories to envision seamless integration into users' lives. During this process, I was responsible for visual planning, interface design, mockup creation, storyboarding, and body-storming to build empathy.

My team collaborating together to learn about Blender

The initial mockups I created to showcase our envisioned interactions and design

OUTCOME

Learned to consider various contexts and iterated the design to simplify interactions

After presenting our storyboard to industry experts and our peers, my team gained insights into the importance of considering contexts beyond people's homes. We also refined our design, simplifying its interactions to better align with our desired outcome.

Our storyboard had too many "couch potatoes," which may have limited our context and restricted our ability to envision user interactions with the design

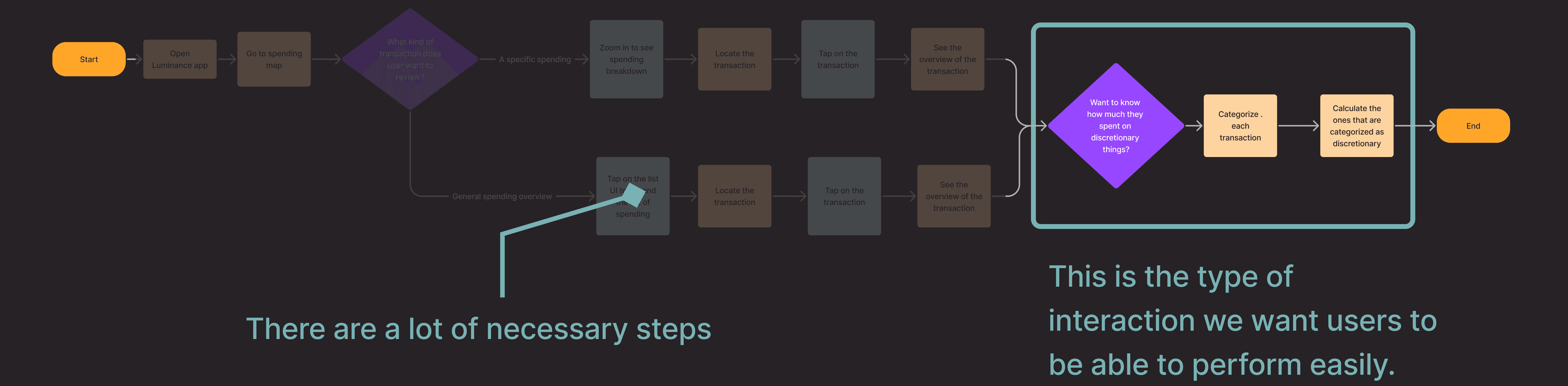

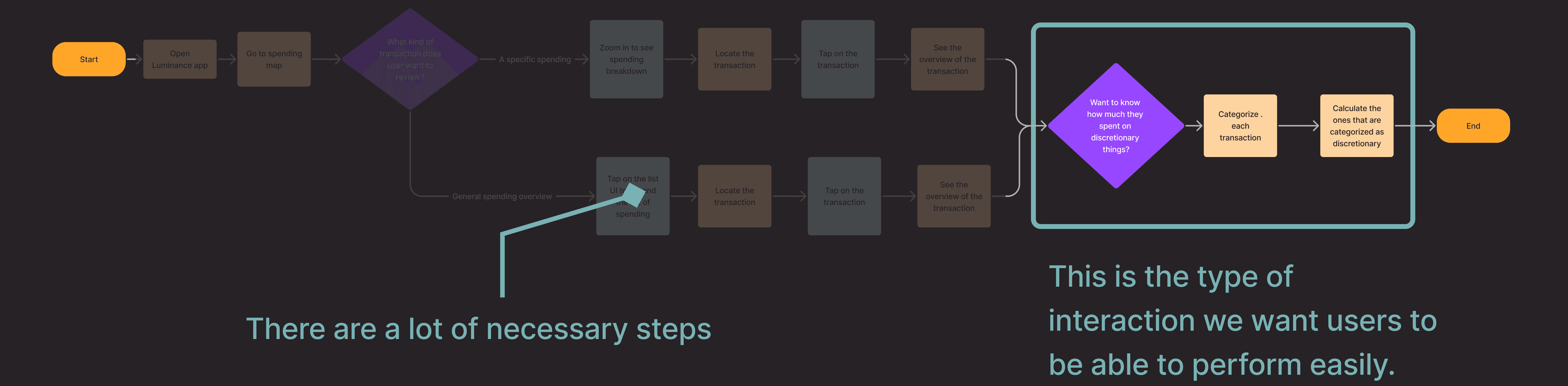

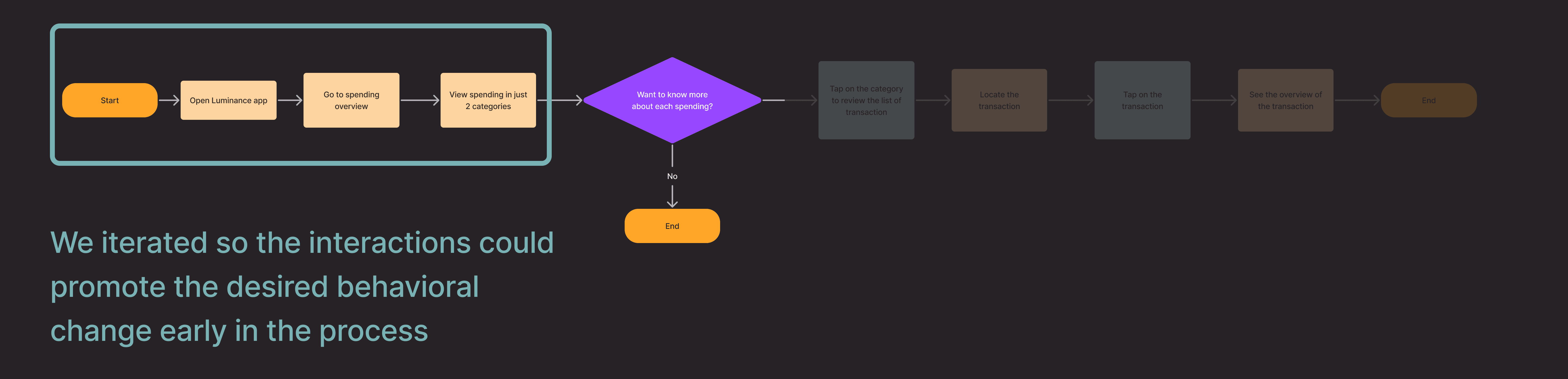

USER FLOW DIAGRAMS

Visualizing user journeys to enhance interactions and refine user stories

My teammate and I developed user flows for multiple interactions, enhancing our storytelling and visualizing the user experience. This allowed us to streamline and eliminate unnecessary interactions. For example:

Spending Overview Goal: Help users track their discretionary spending so they can make informed purchases in the future.

Iteration: Change the map interaction to just categories

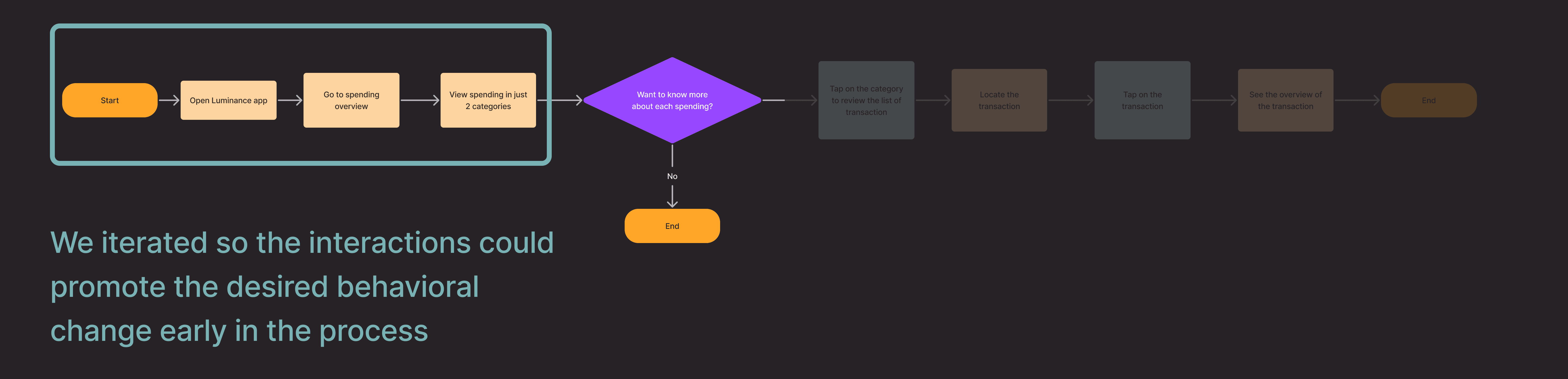

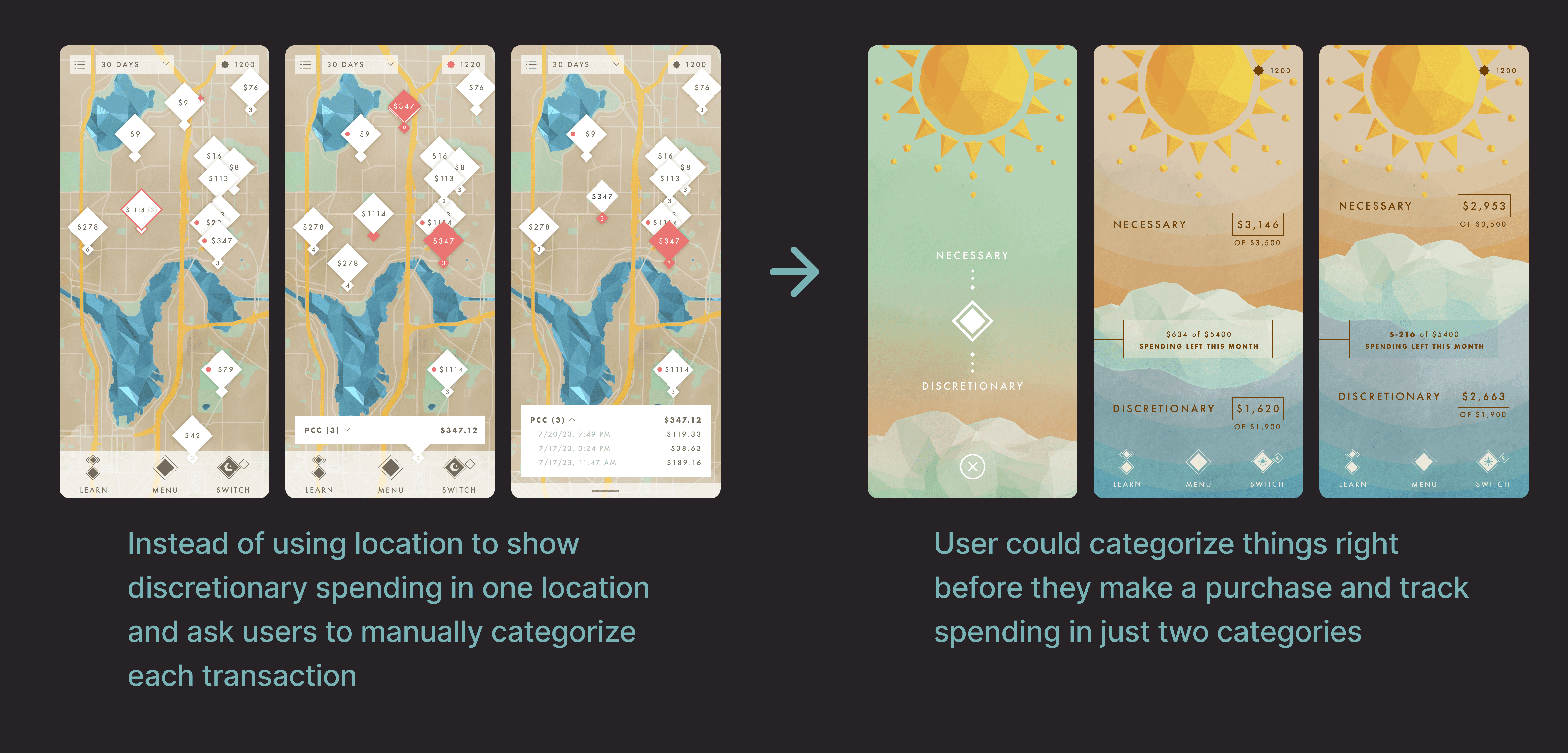

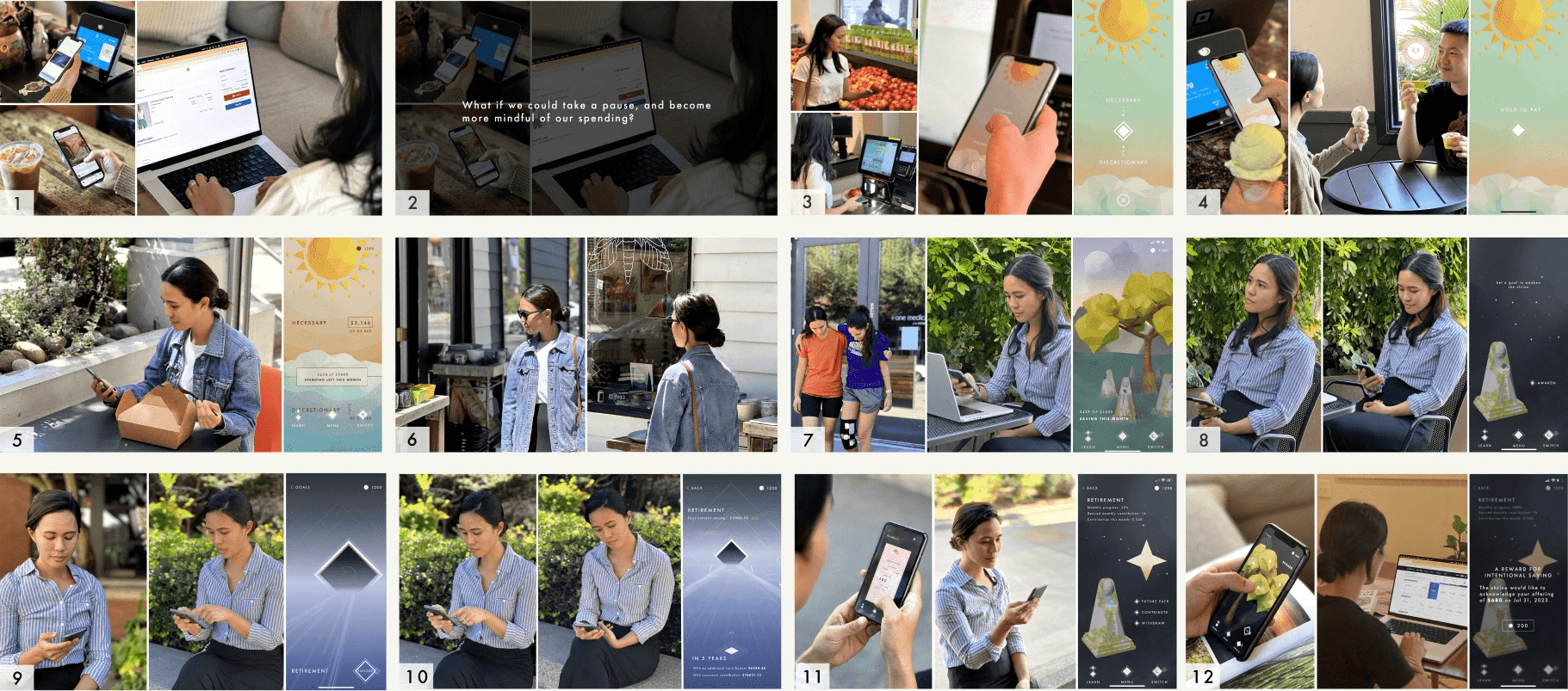

FINAL STORYBOARD (V3)

Extending Design Beyond User's Home

The team considered how our design could serve a purpose outside of a person's home, and we refined our visual designs for a smoother, more natural user experience. I was in charge of storyboarding, photographing, and iterating visual designs for visual clarity.

The final storyboard my team created

OUTCOME

Gained insight into setting context, laying a solid foundation for the video prototype

The final storyboard improved our understanding of design context, sharpened my framing abilities, and promoted team ideation for our video prototype scenes.

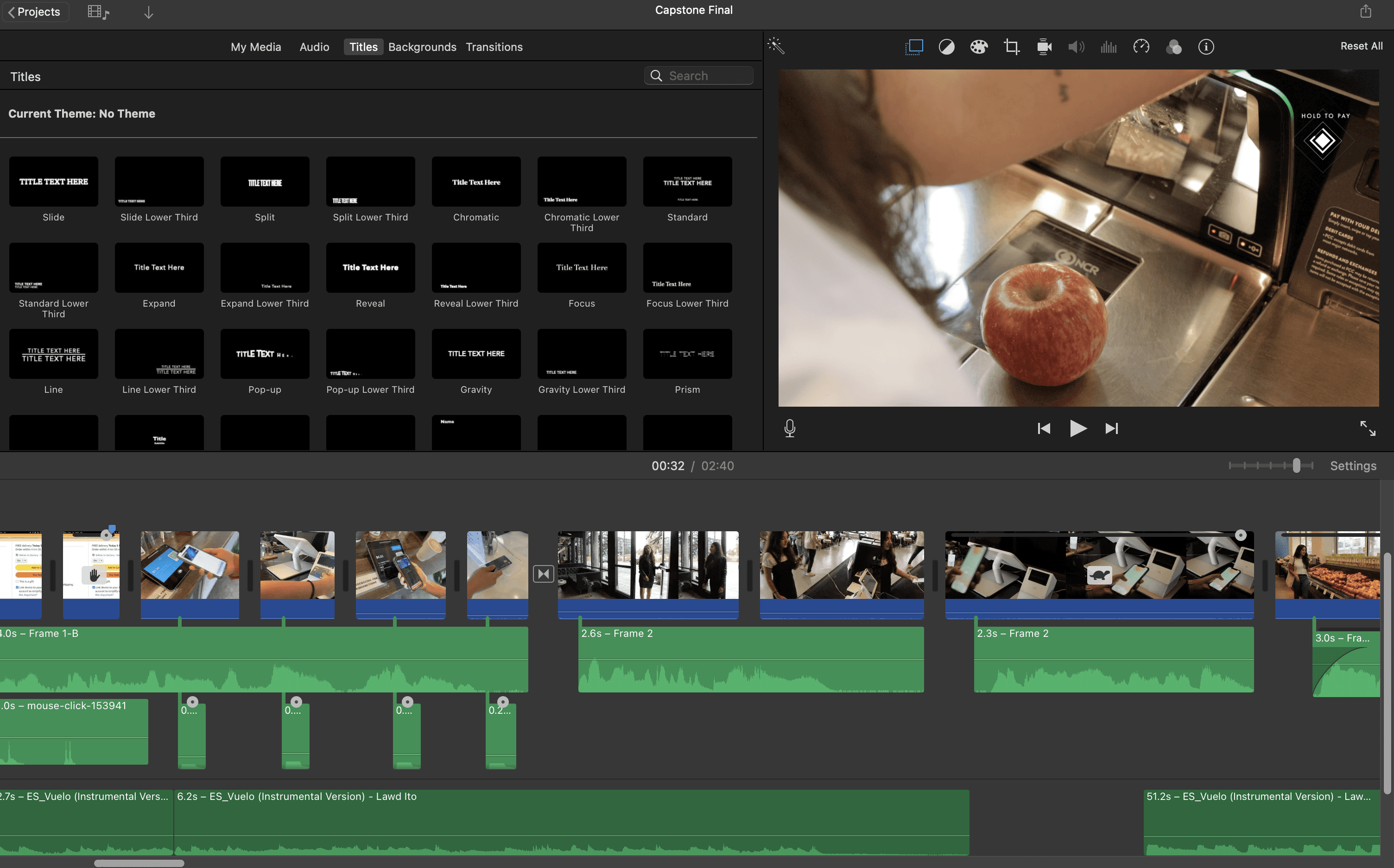

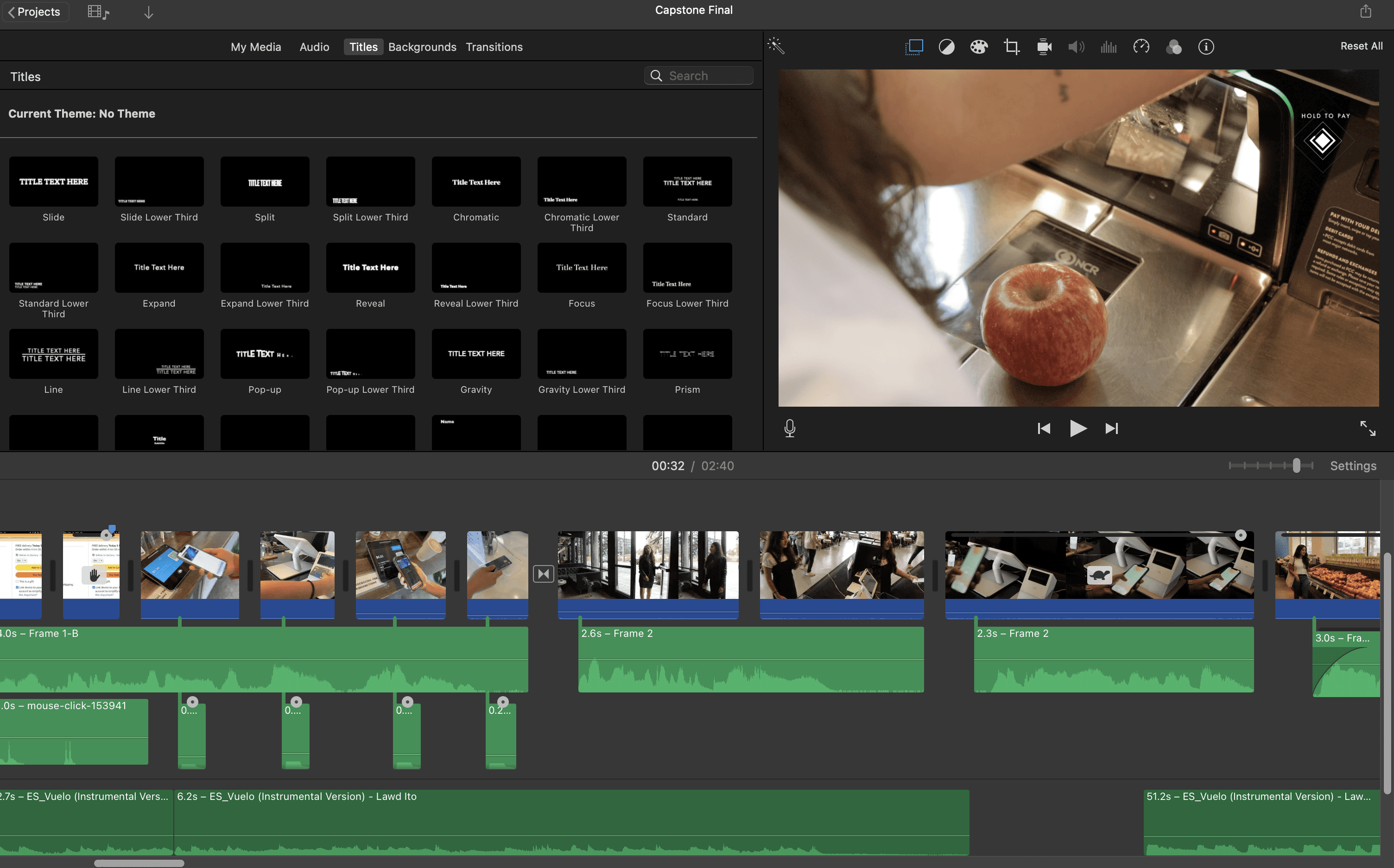

I directed and filmed the scenes for our video prototype

I edited the video prototype in iMovie

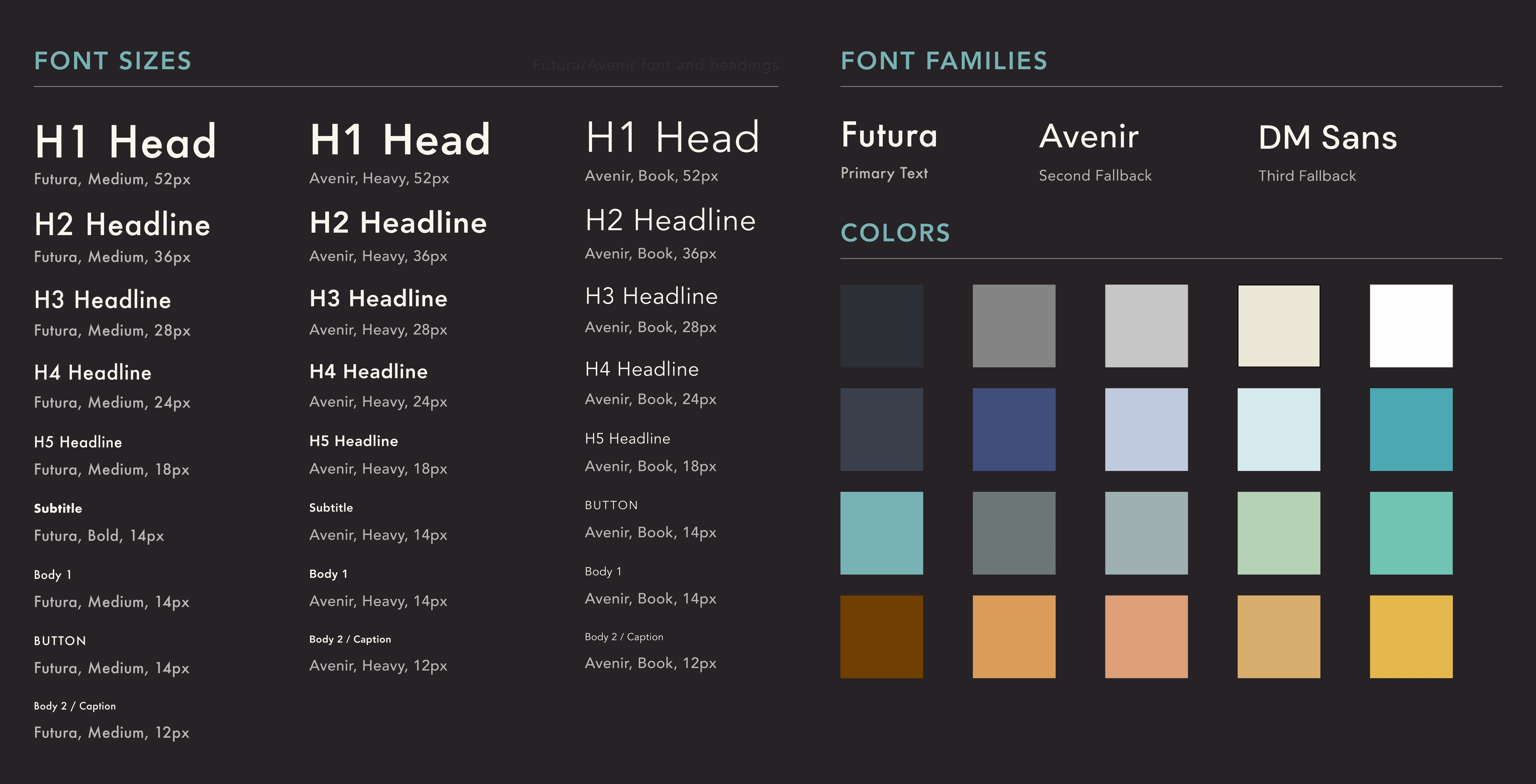

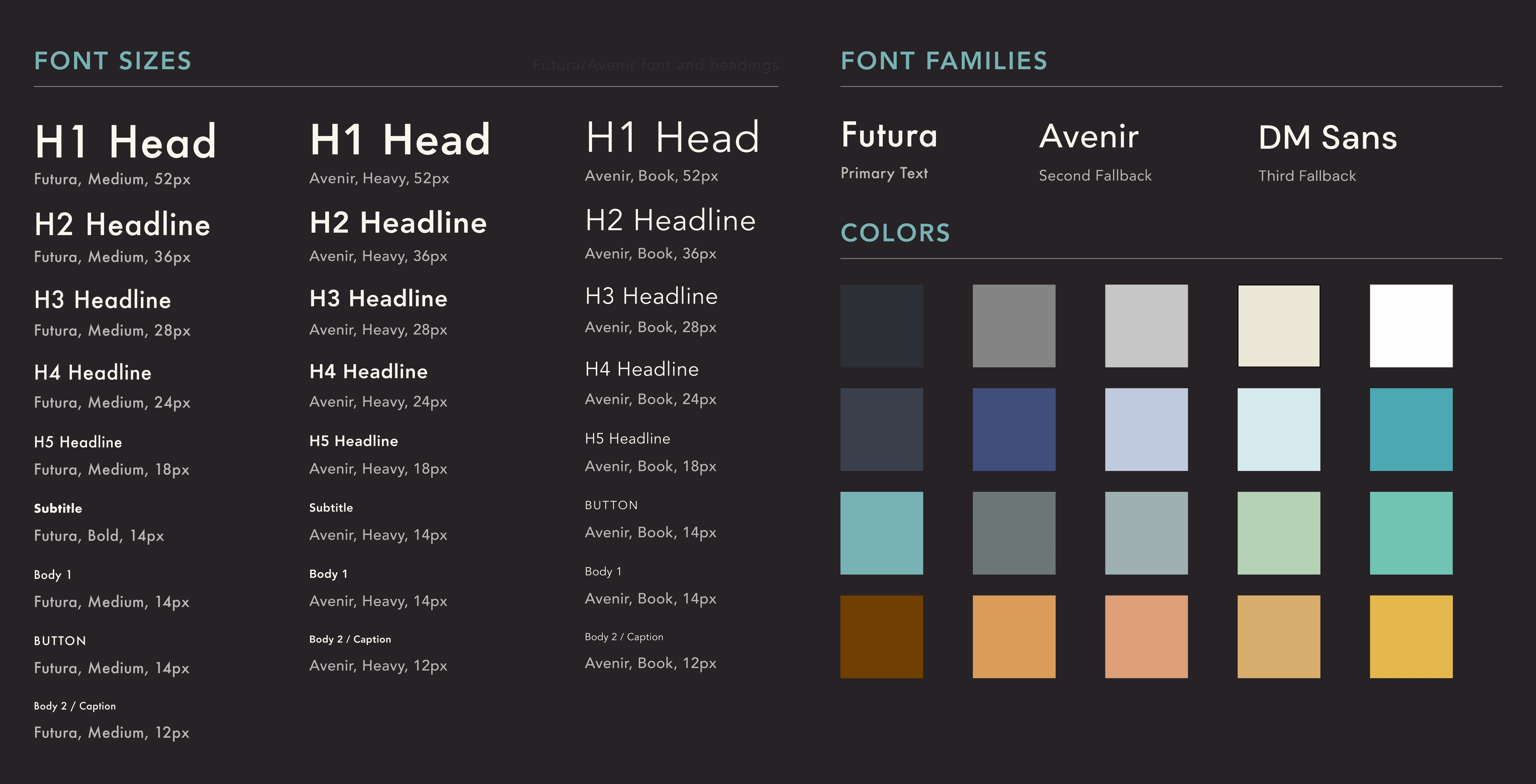

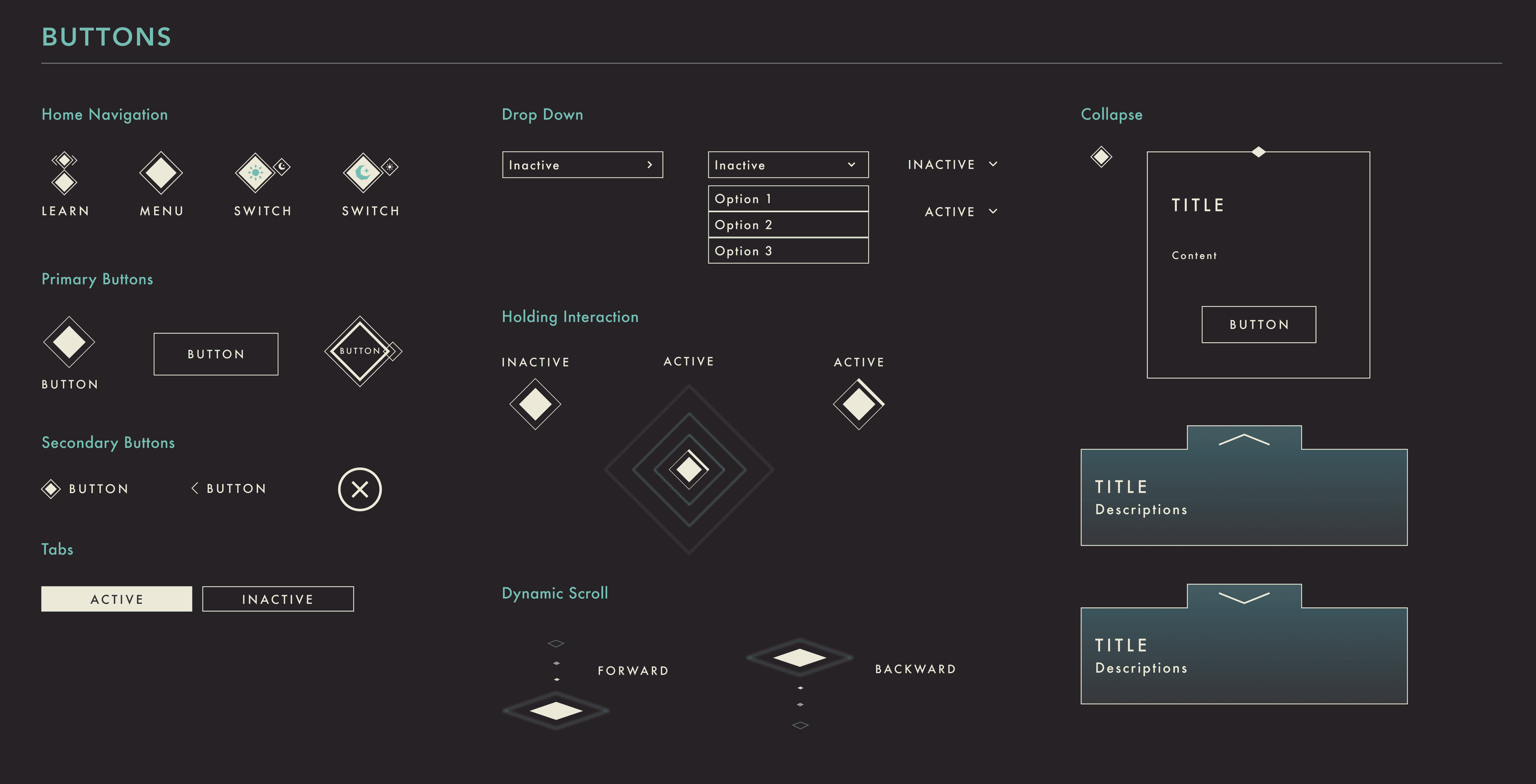

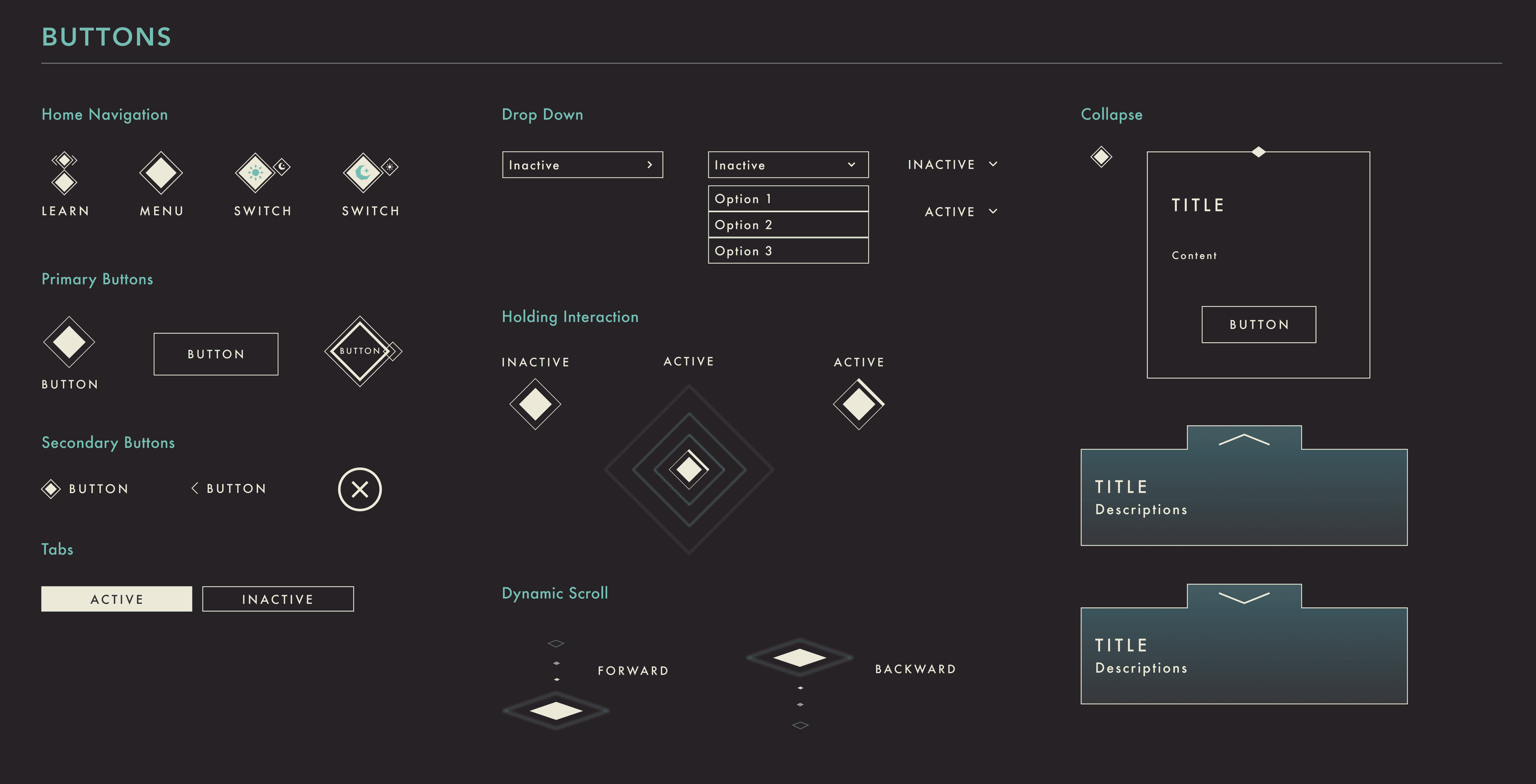

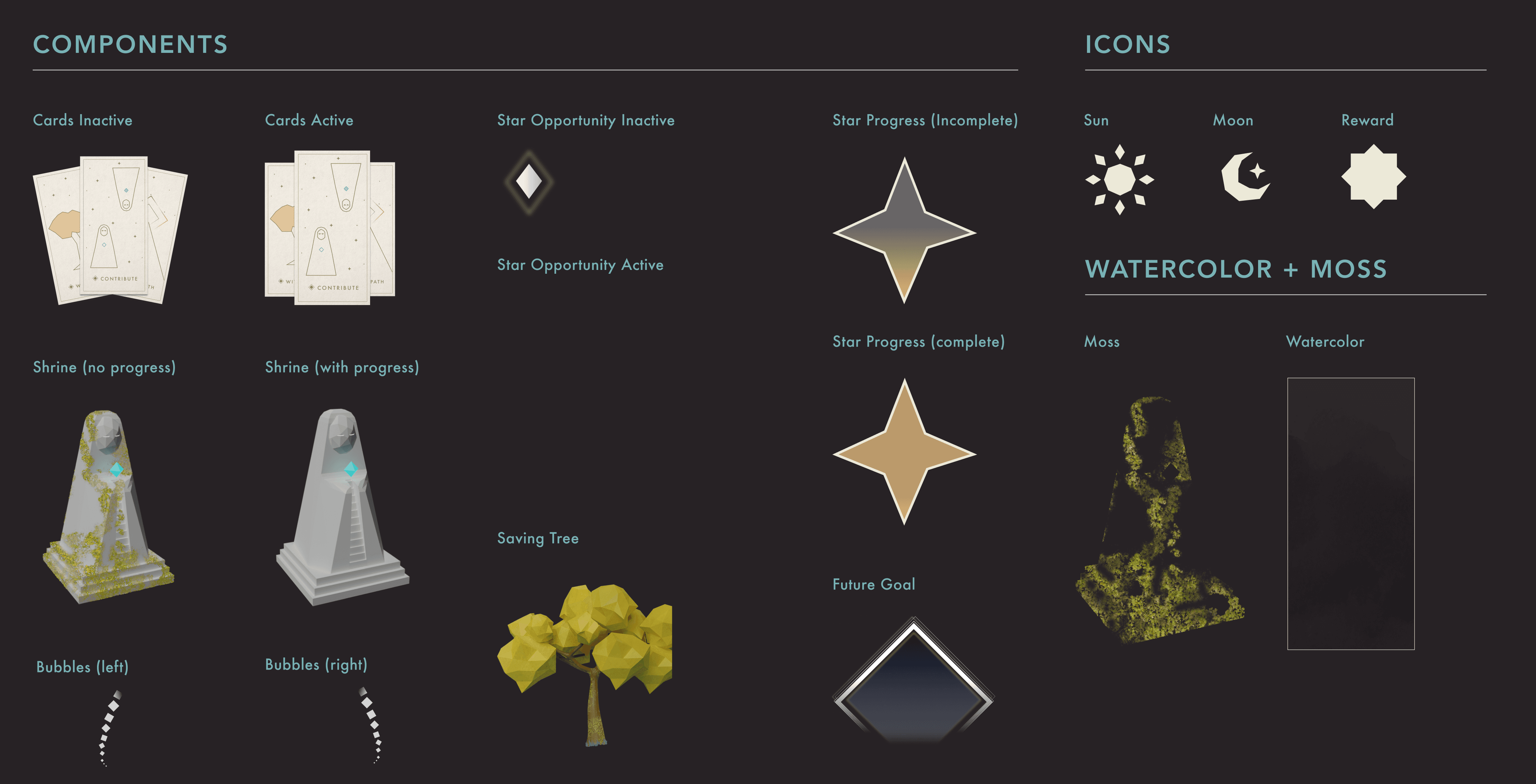

DESIGN SYSTEM & DOCUMENTATION

Capturing the design process and rationales

Following this, we brought Luminance to completion during the last two weeks of our Master's program project. Below is a detailed report outlining our process, design flow, and the reasoning behind our decisions. I also created a design system to unify our design and streamline future iterations.

Final Design Documentation

DESIGN IMPACT

A design that challenges rapid spending and promotes a balanced financial future for young adults

Our design, Luminance, streamlines spending categorization for young adults, embedding a future-forward perspective in financial guidance. We hold that neither spending nor saving is intrinsically good or bad; it's the balance that matters. Through mindful financial management, we aim for Luminance to prompt young adults towards intentional spending, fostering both freedom and a stable future.

REFLECTIONS

(1) If we had more time, I would conduct usability and evaluative testing to validate our assumptions

I recognize that many of our iterations stem from our personal experiences and assumptions. Given more time, I would push my team to undertake evaluative testing to confirm these design premises.I'd also conduct usability tests to gauge user comprehension of our interactions, especially their feelings towards features like 'hold to pay'.

(2) We could have prioritized the narratives earlier and delved deeper into the overall design experience

Initially, our team was overly engrossed in game elements, sidelining the narrative's importance. This project underscored the significance of narratives for me. In future, I'd emphasize the narratives earlier, allowing ample time to assess the broader design experience.

(3) We could have allocated more time to assess extreme scenarios and view the design through a product and business lens

Given that our design offers real-world rewards like flight miles, it's crucial to explore potential misuse that deviates from our intended purpose. It would also be beneficial to investigate how we can use our current features to bridge user desires with business objectives, and we could use that to inspire our product success criteria for better design evaluation.

(4) This is a journey highlighting visual challenges and the essence of teamwork

Despite our diverse backgrounds and no prior art experience, this project introduced us to tools like Blender, AfterEffects, and ProtoPie. While my visual communication skills were useful to guide the team, it was our collective mentorship and support that marked our success. This emphasized the vital role of teamwork and communication in design.

ACKNOWLEDGEMENT

I'd like to thank all of my teammates, as well as the faculties and our advisor Holly for providing critical feedback that helped us move forward. I couldn't have done it without them <3.